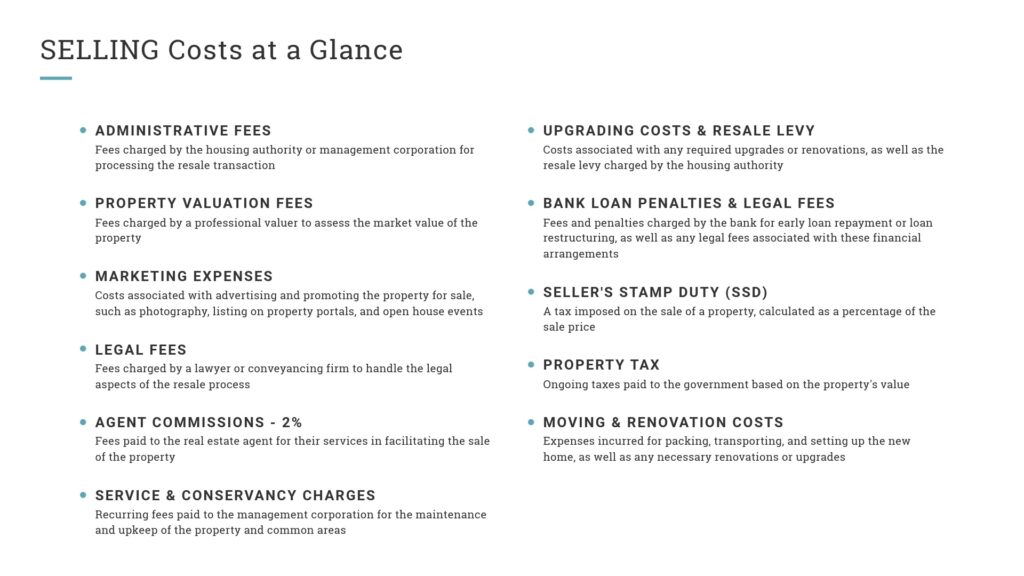

The Comprehensive Guide to the Costs of Selling Property in Singapore

Last Updated on September 5, 2025 by Editorial Team

Explore our guide on the costs of selling HDB and private properties in Singapore. Understand the fees, timeline, and insights to make informed decisions in the property market.

This comprehensive guide offers an in-depth analysis of the expenses of selling your condo or HDB Singapore. Understanding these costs will help you plan your finances accordingly, ensuring you won’t be caught off guard by unexpected bills.

Administrative Fees

| HDB | Private Property | Payment Timeline |

|---|---|---|

| $40 – $80 | N/A | Upon submission of the Resale Application |

When selling an HDB property, you must pay administrative fees upon submission of the Resale Application. These fees cover the processing of the application and other related administrative tasks. Private property owners do not incur this cost.

Property Valuation Fees

| HDB | Private Property | Payment Timeline |

|---|---|---|

| $200 – $400 | $200 – $400 | When setting the price for your property |

Before listing your property, it’s crucial to obtain a professional valuation. This will help you determine the right asking price. HDB and private property owners typically pay between $200 and $400 for a licensed valuer’s services. However, banks may also provide indicative valuations.

Marketing Expenses

Home Staging

| HDB | Private Property | Payment Timeline |

|---|---|---|

| From $1,000 onwards | From $1,000 onwards | When listing your property / conducting home viewings |

Home staging is an optional but effective marketing strategy. Furnishing and decorating your property can create a more attractive living space for potential buyers. The cost of home staging varies depending on the size and type of property.

Professional Photography

| HDB | Private Property | Payment Timeline |

|---|---|---|

| From $300 onwards | From $300 onwards | When listing your property |

High-quality photographs are essential for showcasing your property’s best features. Hiring a professional photographer can help capture the essence of your property and attract more potential buyers.

Legal Fees

| HDB | Private Property | Payment Timeline |

|---|---|---|

| $288 – $2,300 | $2,500 | HDB: After HDB accepts your Resale Application<br>Private Property: Deducted from cash proceeds, or close to the sale completion date |

Legal fees cover the costs of conveyancing, caveats, and other legal procedures. For HDB properties, using HDB’s solicitors is the most cost-effective option, with fees ranging from $288 to $2,300. Private property owners can expect to pay approximately $2,500 in legal fees.

Agent Commissions

| HDB | Private Property | Payment Timeline |

|---|---|---|

| 1 – 2% of purchase price + GST | 2 – 3.5% of purchase price + GST | Typically at the close of the sale |

Real estate agents facilitate property selling and help you find potential buyers. Their commission is calculated as a percentage of the purchase price plus GST. HDB property owners can expect to pay between 1% and 2%, while private property owners usually pay between 2% and 5%.

Service & Conservancy Charges

| HDB | Payment Timeline |

|---|---|

| Dependent on the flat type | Before attending the HDB Resale Completion Appointment |

Service & Conservancy Charges (S&CC) are fees payable by HDB flat owners to the Town Council for maintaining and managing the estate. These charges must be settled before attending the HDB Resale Completion Appointment.

Upgrading Costs and Resale Levy

| HDB | Payment Timeline |

|---|---|

| If applicable | Upon purchasing your second flat or deducted directly from sale proceeds |

HDB owners may need to pay for upgrading costs if their property has undergone upgrading. These costs are typically settled using cash proceeds or CPF. Additionally, some HDB owners may be required to pay a resale levy when purchasing a second flat. This amount is deducted directly from the sale proceeds or paid upon purchasing the second flat.

Bank Loan Penalties and Legal Fees

| HDB | Private Property | Payment Timeline |

|---|---|---|

| If applicable | If applicable | At the close of the sale |

Property owners who have taken a bank loan may be penalized for early loan termination. Additionally, legal fees may apply for bank loan-related procedures. These costs are typically paid at the close of the sale.

Seller’s Stamp Duty (SSD)

| HDB | Private Property | Payment Timeline |

|---|---|---|

| If applicable | If applicable | Within 14 days after the S&P agreement is signed |

Seller’s Stamp Duty (SSD) is a tax imposed on property owners who sell their property within a specified period after purchase. To determine if you must pay SSD, consult the guidelines provided by the Inland Revenue Authority of Singapore (IRAS). SSD must be paid within 14 days after signing the Sale and Purchase (S&P) agreement if applicable.

Property Tax

| HDB | Private Property | Payment Timeline |

|---|---|---|

| Prorated amount upon completion of sale | Prorated amount upon completion of sale | Payable in January for the year in advance |

Property tax is an annual tax levied on property owners in Singapore. Upon selling your property, you must pay a prorated amount for the remaining year. This amount is payable in January for the year in advance.

Moving and Renovation Costs

Moving and renovation costs are essential expenses to consider when selling your property. These costs include the fees for packing, transporting, and unpacking your belongings and any necessary renovations or repairs to ensure the property is in optimal condition for the new owner. It is advisable to complete these tasks before the close of the sale, allowing the buyer to confirm vacant possession.

Please note that the figures provided in this guide are estimates and may vary depending on the specific firms, banks, or individuals you engage. In addition, not all expenses may apply to your situation. For example, if you have taken an HDB loan instead of a bank loan, HDB does not charge an early repayment fee.

In summary, selling a property in Singapore involves various costs and fees, from administrative and legal fees to marketing and moving expenses. Being well-informed about these costs will enable you to plan your finances and navigate the property-selling process easily.

Selling Your Property in Singapore?

Licensed Property Seller Services with Low Commission rates.

Helpful Tip When Selling Property in Singapore

Why Use a Professional Agent?

Selling property in Singapore can be complicated and time-consuming. Hiring a professional real estate agent can simplify the process and offer several benefits:

Expertise and Experience

Real estate agents possess the necessary knowledge and experience to handle the property market’s complexities, including legal requirements and paperwork.

Accurate Valuation and Pricing

A professional agent can accurately value your property and create effective pricing strategies based on location, condition, and market trends.

Effective Marketing

With access to various marketing channels, including networks, online portals, and social media, agents can reach a wide audience of potential buyers.

Time and Effort Savings

Managing tasks like arranging viewings, negotiating, and handling paperwork becomes easier when a professional agent takes over, saving you time and effort.

Skilled Negotiation

Experienced negotiators can secure the best price for your property and resolve any issues that arise during the process.

Network of Professionals

Real estate agents can connect you with mortgage brokers, lawyers, and property inspectors, streamlining the selling process.

Finding the Right Agent

To find a value-driven agent, interview several candidates to assess their professionalism, communication skills, and market understanding. Choosing the right agent ensures you benefit from their expertise and successfully navigate the selling process.

How Quickly Can You Sell Your Property?

Condo Selling Timeline

- Paperwork and Listing: 1-3 weeks

- Viewings and Negotiations: 1 day to 6 months

- Granting Option to Purchase (OTP): 1 day

- Engaging Solicitors and Exercising OTP: 1 day to 2 weeks after granting OTP

- Payment of Stamp Duties: 1 day to 2 weeks after exercising OTP

- Completion and Full Payment: 8-10 weeks after exercising OTP

Realistic Timeline: About 5 months

HDB Selling Timeline

- Paperwork and Listing: 1-3 weeks

- Viewings and Negotiations: 1 day to 4 months

- Granting Option to Purchase (OTP): 1 day (minimum 7 days after resale checklist)

- Buyer Exercises OTP: 1 day to 2 weeks

- Submit Resale Applications: 1-7 days

- First HDB Appointment: 1 week to 1 month

- Second HDB Appointment: 6-8 weeks

Average Timeline: About 9 months

Factors like paperwork, viewings, negotiations, and legal processes can influence these timelines.

If you’re unsure about whether to start selling your condo or you’d like to chat more, we’re here to help. No pressure, no hard sell, but just a friendly chat for us to understand your needs and help you along.

Jae Tan, an award-winning ERA Realty Network agent and speaker at Real Estate Conversations, specialises in buying resale or new launch properties, selling, and renting homes. With multiple Top Achiever awards including The Myst (2025).

Known for sincerity and long-term client relationships, Jae delivers trusted results in Singapore real estate.

Connect with Jae today for your property needs!

Licensed Property Seller Services with Low Commission rates.