Singapore’s property market is considered a good investment sector, attracting investors and speculators looking to profit from the nation’s vibrant conditions.

There is no shortage of information available to beginning investors who want to make money in Singapore real estate. And just as important is the information about what pitfalls to avoid so you don’t become a statistic of the property game.

While many investors start out with the intention of making it big in real estate, few will ever get past their first investment, and even fewer will create real wealth by climbing to the top of the property ladder.

2025 Q1 Upcoming New Condo Launch

The Orie Condo, a 99-year leasehold in District 12, is located in Toa Payoh, near Braddell MRT and top schools such as CHIJ Primary (Toa Payoh). The residence offers easy access to a variety of neighborhood amenities, and shopping enthusiasts will appreciate nearby options like Junction 8 and Zhongshan Mall.

Sales Preview 3 Jan 2025.

Elta Condo, a 99-year leasehold new condo in Clementi, offers modern living with access to malls, eateries, and essential services. It boasts excellent connectivity via AYE and major roads, while Clementi MRT and Bus Interchange (1 km away) provide easy public transport access, ensuring a convenient lifestyle for residents.

Sales Preview 7 Feb 2025.

Parktown Residences is a mixed-use development at Tampines Avenue 11, integrating residential, retail, and community spaces. Developed by UOL Group, CapitaLand, and SingLand, this 99-year leasehold project features 1,193 units. With direct connectivity to Tampines North MRT.

Sales Preview 8 Feb 2025.

2024 Popular New Launch Condo

Meyer Blue is a highly anticipated freehold condominium with sea view set to grace the vibrant East Coast of Singapore in District 15. With its prime location and luxurious amenities, it promises an exclusive and serene lifestyle amidst the bustling city life.

Launching in 2024.

The Chuan Park, a collaboration between Kingsford Group and MCC Singapore, is set to redefine the Serangoon precinct, District 19, with a modern 900-unit development on the former Chuan Park condo site spanning 400,588 sqft.

Launching in 2024.

Bagnall Haus is a new freehold condo poised near the Sungei Bedok MRT and Bedok South Integrated Transport Hub, 1KM from Temasek Primary School and featuring 113 units across five floors.

Launching in 2024.

How do people make money from property?

Capital Appreciation

Capital Appreciation occurs when the value of the property increases above its purchase price over time. For instance, when a property that you paid $500,000 for rises in worth over time and commands a value of $800,000, the Capital Appreciation of the property is said to be $300,000.

If the property were to be sold off for a price greater than its purchase price, you would be able to reap earnings known as Capital Gains through Capital Appreciation. Therefore, it is imperative to watch out for elements that can contribute to Capital Appreciation in the future.

One of the most common ways to make money through property investment is buying and selling, or ‘flipping’ properties. You can use this method by buying a property and then reselling it for a profit. The defining characteristic of this method is speed; you’ll want to sell your property as soon as possible, in order to limit the risk to your capital. However, this method relies on capital appreciation—which is something you may not always be able to control.

Rental Income

Rental Income is the amount of money collectible from a tenant who uses your space and it is a potential avenue for making money. The amount of money you can obtain from collecting Rental Income is known as Rental Yield.

It is the summation of the Rental Income you would earn in a year as a percentage of the property’s price. Thus, if you are renting out a property that was purchased for $500,000 at $5,000 a month, you would earn $60,000 a year and the rental yield would be 12% [(60,000/500,000) x 100%].

A higher Rental Yield not only equates to a higher return on investment, but it also helps property buyers in making property loan repayment.

In the buy-and-rent method of property investing, you move into the role of landlord. This method is distinguished from property flipping in that it involves a long-term view. Unlike in property flipping, your aim is to hold the property and rent it out for income. In order to turn a profit, your rental income has to be higher than your mortgage payments (plus amortised costs of any renovations or repairs).

Investment in Real Estate Investment Trust (REIT)

Investing in REIT involves placing your money in a pool, together with other investors, in a joint investment program that is used to invest in a portfolio of real estate assets that have the potential of making money.

REITs can take the form of commercial, retail, industrial, hospitality and healthcare REITs and each type comes with its own set of associated risks and opportunities.

REITs are professionally maintained, and earnings derived from the investments are typically distributed to investors at regular intervals. REIT aims to generate income distribution and long-term appreciation.

Real estate investment trusts (REITs) are a popular way to invest in property without having to deal with all the hassle first-hand. They work like any other unit trusts or mutual funds, in that your money is pooled together with other investors, and used to invest in properties. Different REITs deal in different types of properties, such as residential, office, retail, hospitality, or any mix in between. You’ll need to pay a fee for the REIT to be managed professionally. For an even more hassle-free investment experience, some robo-advisors such as Syfe offer REITs-based portfolios.

Different Property Regions in Singapore

Core Central Region (CCR)

The CCR comprises the traditional prime areas (districts 9,10 and 11), the Downtown Core and Sentosa and it is an area where high-end, luxurious and mostly freehold properties are situated. Therefore, it is no surprise that buyers of such properties are individuals with high net worth.

Rest of Central Region (RCR)

The RCR occupies the space between the high-end properties in the CCR and mass-market properties in the OCR and pricing-wise, it is deemed the mid-tier region.

However, the disparity between the RCR and CCR is observed to be narrowing, especially in areas where urban development, revitalization, and infrastructure development have occurred.

Therefore, the RCR finds popularity amongst diverse buyer groups, ranging from investors to young families and even empty nesters.

Outside Central Region (OCR)

The OCR dominates approximately three-quarters of Singapore and comprises mass-market properties of a lower price range, including the Executive Condominiums.

Apart from price, private residential developments in the OCR are also characteristically larger in scale and the tenure of these properties is usually 99-year leasehold.

The generous sizing and greater unit count of OCR developments also allow for a range of eye-catching facilities, thereby making it attractive amongst young couples and millennial families.

Golden Tips to Spot a Good Investment Property

Look out for a Good Entry Price

A property that has a good entry price is one that is selling at a price lower than its current value. For instance, if a property’s transactions average $1,000 per square foot (psf) and it is selling for $800 psf, it has a good entry price.

Buyers should be cautious not to purchase property that is priced higher than its current value with an anticipation that future transactions will be able to support it. A good place to get a gauge of a property’s historical transaction trends over the last six months is the URA website.

Look Out for Good Long-term Values

It is important to note that cheap property does not necessarily equate property that has high long-term value. The long-term value of a property can be influenced by a myriad of factors, such as having convenient transportation infrastructure, or the construction of nearby amenities can raise property value in the future.

Notable things to watch out for include the development of business hubs, major park, and recreational areas and the development of educational institutions. Not only will these factors benefit buyers looking for a home, but it will also benefit buyers who intend to rent out their property as such properties often enjoy good recurring rental take up.

Besides, freehold properties tend to demand higher premiums. Studying these factors that will ultimately lead to high Capital Appreciation and Rental Yield beforehand will allow one to more accurately determine if a property has good long-term value.

Visit Property Auctions

At property auctions, buyers may chance upon properties that are selling at irresistible prices. For instance, fire sales take place when an owner of a property desires to let it go quickly and cheaply as it has become too expensive for him to service. Moreover, at property auctions, if the reserve price is not achieved, you may approach the sellers directly and take a shot at requesting a private deal.

Get Direct Developer Prices & Discount on New Condominiums

5 Tips on Wise Property Investing in Singapore

Learn How Leveraging Works

While property purchase is a huge expenditure, one does not necessarily need a huge chunk of money to acquire a property – a mix of your available cash, CPF and a loan from a bank can be utilized. Thus, it is vital to take advantage of the large leverage provided by the bank.

At 2% per annum, a housing loan is one of the cheapest loans that you will be able to get. Yet, there are ways to further reduce costs, such as through refinancing or accepting favorable lock-ins at the right time). Additionally, with in-depth research, you will be able to seek out the cheapest rates out of the many loans available.

Be Prepared to Bite the Bullet

Property that comes with good growth prospects may come with certain hindrances, such as having an unfavorable location. Nonetheless, the eventual long-term payoff from future developments will make putting up with the inconvenience for a few years all worthwhile.

Make Sure Everyone is On Board

It is important to see eye to eye with those whom you are sharing the property with as property investment necessitates complex decision making (e.g. how to rent) and when such decisions need to be made, they often come with an immense financial ramification so there should be no space for mistakes. Thus, it is wise to have a shared investment plan that all the property’s stakeholders can agree on.

Attention to Detail

During the process of owning property, the manifestation of the occasional small expense is unavoidable. However, instead of sweeping these expenses under the rug, it is crucial that these expenses be spotted and subsequently examined in detail as they may add up to huge losses that could potentially eat into your gains. These small expenses can take the form of an increase in maintenance fees or even in the cost of supplies used by your contractor.

Be at least 6 Months Ahead of Expenses

It is good practice to always plan for the worst because you never know when you may lose your job and be unable to service your loan or when you may find your next tenant. In order words, in anticipation for the worst, you should have enough reserves to tide you through at least six months. Reserve sufficiency also prevents you from making rash decisions such as divesting yourself of a property at an unfavorable price just to cut your losses or settling for just any tenant at a low rent.

7 Key Factors that Affect Singapore’s Property Prices?

Location and Infrastructure

The price of a property can be influenced by a myriad of factors, such as the proximity of the property to major arterial expressways or MRT stations, or the construction of nearby convenient amenities. Other factors include the development of business hubs, major park and recreational areas and the availability or possibility of relocation of renowned educational institutions close to the property.

Developments that possess these favorable factors often command a premium because they are often in high demand amongst both buyers looking for a home and buyers who are looking to rent out their property.

State and Condition of the Property

The price of older properties tends to be lower as they often require a lot of work in order to be restored to their original state. Conversely, property that has undergone major renovation and upgrading works have higher asking prices.

Lease

A good proportion of Singapore’s residential property is leasehold. Depending on the duration of the lease, the price of the property may differ. Properties that are approaching the end of the lease may experience a sharp decline in their values. Therefore, freehold property tends to maintain its value better over time, but they often come with hefty price tags.

Interest Rates

Interest rates significantly impact borrowing costs, directly influencing buyers’ affordability in the property market. Over the past few years, higher mortgage rates prompted many homebuyers in Singapore to opt for fixed-rate home loans or refinance their properties to stabilise monthly payments. However, with expectations of further rate cuts from the US Federal Reserve in 2025, the Singapore Overnight Rate Average (SORA) could trend lower, potentially falling toward 2%.

This anticipated decline in SORA may encourage buyers who previously held off due to high borrowing costs to re-enter the market, seizing opportunities for more favourable deals. It could also provide greater flexibility for buyers preferring floating-rate home loans, making property purchases more appealing in the evolving economic landscape.

Government Policies

The Singapore government frequently implements policies to ensure a stable property market. A good example is the cooling measure in 2023 to increase Additional Buyer’s Stamp Duty (ABSD) rates, particularly for foreign buyers (60%) and second-home buyers (20% to 30%). The policy stabilised sky-rocketing private property prices.

An additional measure to lower the loan-to-value (LTV) limit from 80% to 75% was introduced in August 2024 to cool the HDB resale market and support lower- to middle-income first-time home buyers.

Economic Climate

The overall health of the economy directly impacts property prices. A robust economy fosters a vibrant property market, while economic slowdowns often lead to more cautious behaviour among buyers and investors.

In 2024, Singapore’s economy experienced moderate growth, setting the stage for a stronger recovery. With projections of lower mortgage interest rates and improved economic conditions in 2025, the property market is poised for increased activity and renewed vibrancy.

Prices of “Comparables” Units Nearby

Comparable properties are those that are sold in the same area as the property that you wish to buy, and they may exert an influence on the price of that property.

Valuers tend look at the recent sales of properties with similar features as a gauge in determining your property’s potential worth. Therefore, foreclosures and short sales can reduce the area’s average sales price.

Investment Options Beyond Singapore Physical Property

If you believe in the growth and resilience of the Singapore property market, there are ways to invest without owning physical property.

REITs

Real Estate Investment Trusts (REITs) allow you to buy shares in companies that own or manage income-producing real estate. They trade on stock exchanges like regular shares and are popular because they must distribute 90% of their income as dividends. Investing in REITs is accessible and affordable, with a minimum investment often as low as $200.

Property Stocks

Investing in property stocks is another option. These companies own and lease or sell multiple properties. Unlike REITs, property stocks are not required to pay out 90% of their income as dividends, and their valuation can be influenced by other business activities. It’s important to understand the company’s fundamentals before investing.

Property ETFs

Property Exchange-Traded Funds (ETFs) track the performance of an underlying index and trade like stocks. They allow you to invest in a basket of REITs, offering diversification across different regions and countries. This can help capture returns from higher-yielding properties globally.

Property tax in Singapore

Property tax is levied on the annual value of a property and the amount of tax chargeable on a property are multi-tiered and depends on whether you are an owner-occupier (i.e. purchased property with an intention of living there).

Owners of non-residential properties will also have to pay property tax at a rate of 10% of the property.

For a more accurate derivation of the amount of tax you have to pay, you may visit IRAS website to find out the value of your property and plug the value into the online calculator to determine the tax payable.

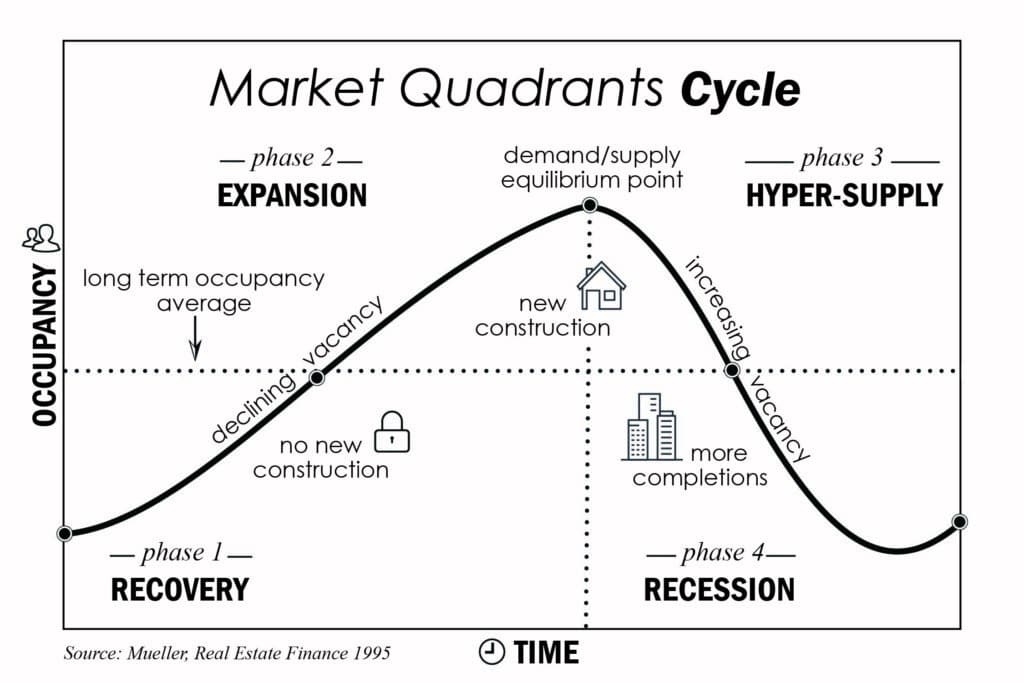

Property Cycles and Finding Profitable Property Investments in Each Market Cycle?

When making real estate investments, timing is of the essence. In order to maximize profits, one has to time his buying and selling investment decisions well by analyzing the price fluctuations within the property cycles.

Recovery

During this phase, demand is often sluggish and indicators signaling an impending end to market decline are apparent. These indicators usually show a rise in demand, such as a rise in property viewings or a fall in vacancy rates.

However, given the difficulty in establishing this phase, investors who speculate an imminent recovery should purchase property to reap strong returns in the impending expansion phase.

Expansion

The Expansion or “Boom” phase typically occurs when the economy burgeons and more jobs are created, leading to rising rents and a fall in vacancy rates. During this phase, investors have higher morale and are confident in making real estate purchases.

This drives up the demand and subsequently causes housing prices to rise rapidly. It is also a time when developers overhaul and renovate older property for resale in order to take advantage of the growing property prices.

Peak

Although property prices tend to rise rapidly in the Expansion phase, it eventually slows down. This is when the Peak phase is said to have arrived. Professionals claim that the Peak phase is when you should be selling your property if you do not wish to hold it past the next cycle.

The Peak phase can be distinguished via the following characteristics:

- A rise in property prices for several quarters

- A rise in property transactions

- Housing becomes less affordable

- Implementation of cooling measures

- Significant construction activity

- High levels of borrowing

Recession

Rising vacancy rates, sluggish demand, and declining rents are characteristics of the Recession phase. Property prices tend to be on the decline during this phase and it can be attributed to a couple of reasons, such as oversupply and the presence of property cooling measures. When this happens, property investors begin to exit the market and dispose of their property for fear that their prices may decline further.

Trough

The Trough, despite being the lowest point of the property cycle, comes with subtle indications of recovery and investors with a sharp eye may be lavishly rewarded for having taken risks during the property downturn.

Some professionals may claim that property cycles do not exist due to the difficulty in distinguishing a consistent and regular cycle. However, property values can be observed to rise in waves – in some quarters, strong growth is observed, while in others, slow growth or even a plunge can be seen.

Nonetheless, the golden rule is to always buy low and sell high. What this means is that property should be purchased during the Trough and disposed of during the Peak. Yet, there are limitations in pinpointing the exact phase of the property cycle due to the difficulty in anticipating future prices and the presence of unforeseen external disruptors. One major cycle disruptor in Singapore is the cooling measures put in place by the government since 2013 in a bit to introduce stability and sustainability to the property market.

Hence, potential investors should always keep abreast of the news, in order to better anticipate upcoming property cycles and make sound investment decisions.

4 Sources to Find Property for Sale

Property Listings

Online property portals are a fast and convenient way to seek out property listings. However, these listings are often marked up to allow room for negotiation. Another way of finding property listings is through the classifieds section in newspapers.

Since few people conduct their search via traditional means, it is still advisable to do so via the internet. Examples of online property portals include PropertyGuru, STProperty, 99.co, and Edgeprop.sg.

Sales Launches

If you intend to buy a brand-new property and would like to be able to have a three-dimensional gauge of how it will look like once fully constructed, you can head down to sales launches organized by various developers to view the available mock-ups and ask questions. It is, however, important to note that the acquisition process of an uncompleted property is longer than that of a completed one so it may be unattractive to you if you would like to earn rental income as soon as possible.

Property Auctions

A property auction serves as an avenue for banks, private sellers or developers to sell off property quickly. Therefore, it is an ideal place for scoring a good deal. At the auction, several properties will be put up for bidding and a reserve price (suggesting the lowest acceptable bid) will be established for each property. However, reserve prices may not always be lower than what you may find through other sources.

Property Agents

A fool-proof method of finding your ideal property is through a property agent. Property agents are trained to seek properties that are best able to meet your requirements. In exchange for convenience, property agents receives an agent commission (usually around 1-2%).

This commission may be collected from either the buyer or the seller. In other words, if the agent acts on behalf of the seller, the seller pays the commission so the agent will only recommend properties sold by that seller.

Property Investment in Singapore for Foreigners

Stable and Secure Singapore

As one of the fastest-growing countries in Asia, Singapore epitomizes the ideal environment for investment. Her reliable and competent government plays a pivotal role in ensuring socio-political stability via a powerful yet sound legal infrastructure and the judiciary system. Furthermore, the absence of capital gains tax and estate duty in Singapore offers a conducive environment for investment.

Singapore’s appealing mortgage rates also extend vibrant property investment opportunities to expatriates. On an international scale, Singapore is also deemed as an amazing place to live, work and play and her avant-garde infrastructure, low crime rate, and open economy have allowed businesses to flourish. Therefore, it is no surprise that she has been ranked one of the top choices for Asian expatriates to relocate to over the last five years.

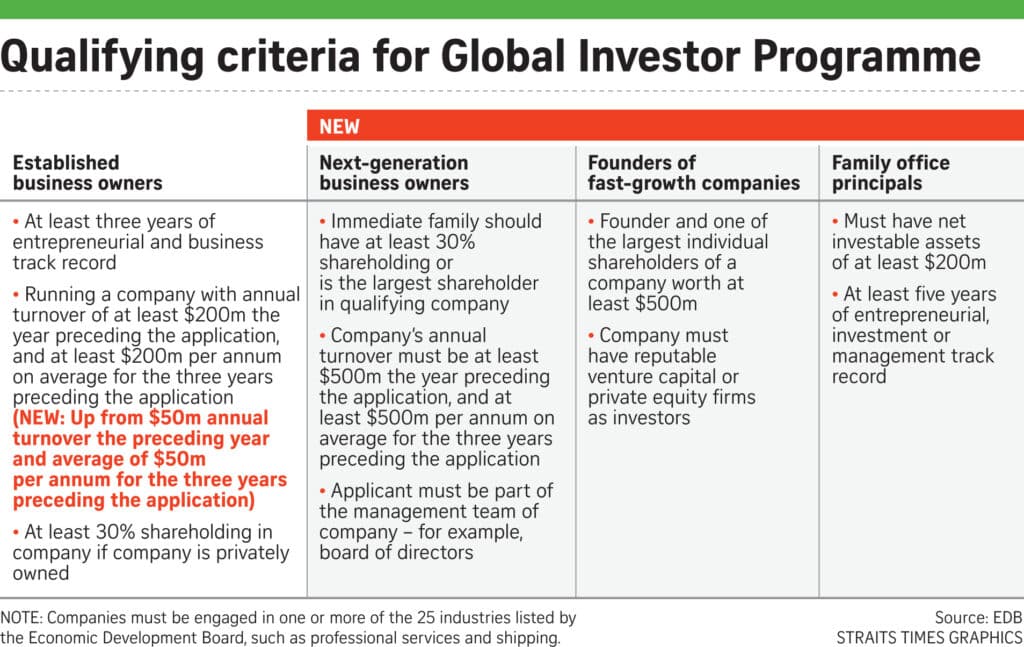

Global Investor Programme (GIP)

Executed by Contact Singapore, the GIP, aimed at entrepreneurs, investors, and businessmen, facilitates the establishment and running of businesses in Singapore.

The GIC will grant qualifying international investors who desire to propel their businesses and investment growth from Singapore Permanent Residency and assist in a variety of immigration processes to facilitate their stay in Singapore. However, one has to possess a considerable business background and a successful entrepreneurial track record to be eligible.

Favorable Factors for Foreign Investors

The following factors also contribute to making Singapore a promising destination for real estate investment:

- Limitations on foreign ownership on condominiums and mixed developments are non-existent

- Clear-cut foreign ownership laws

- Protection derived from property rights and laws and regulations

- Currency regulations, capital gains taxes and withholding tax on property disposals are non-existent

- Foreign investors can enjoy tax deductions on mortgage interest (when a property is rented out)

- Foreigners can enjoy appealing Singapore mortgage loans

- Foreigners can acquire a maximum loan quantum of 70% of purchase price

- Low mortgage interest rates

- Enjoy a rental yield that is higher than the mortgage interest rate

- Investment exits made possible via a resale market

Pros and cons of investing in property

While investing in property may seem less risky than other forms of investment, there are pitfalls to be aware of. Here’s what you need to consider about investing in property.

Pros of investment in property:

- Lower volatility – Property tends to fluctuate less than shares or other investment options.

- Passive income – You receive rental income payments from tenants for using their properties.

- Capital gains – If your property rises in value, you will profit from a capital gains tax when you eventually sell it.

- Physical asset – You’re investing in something tangible that you can hold in your hands.

- You don’t require any specific specialised knowledge to invest into real estate.

Cons of investment in property:

- Cost – In some instances, your rental income may not be able to cover your mortgage payments.

Higher interest rate means higher repayment and lower disposable income. - Vacancy – You might need to pay for the cost of renting out your property if you don’t have tenants.

- Inflexible – You cannot sell off a kitchen if you need extra cash flow when in a hurry.

- Losing value – If the value of your house decreases, you may end up owing more than your house is worth.

- High entry and exit cost – Costs such as stamp duty, lawyer’s fee and realtor’s fee.

Being a landlord comes with hidden costs

Since we’re on the subject, let’s take this opportunity to clear up some common misconceptions about being a landlord.

Difficult Tenants

As landlords, we may sometimes face troublesome tenants who cause damage to property, furnishings, and equipment through carelessness or neglect. Landlords are also at risk of losing rental income and incurring legal fees due to tenants’ actions such as subletting without permission or failing to adhere to house rules.

Property Maintenance

As any homeowner will know, properties require constant upkeep. Pipes and taps leak, furniture gets worn out, equipment breaks down, walls turn dull, bathrooms get gross… the list goes on. Landlords are responsible for the proper maintenance and upkeep of the property. If your washing machine breaks down or your aircon gets choked or if your fridge is faulty, you’ll have to pay for repairs and replacements. And if you want to preserve your beautiful marble countertop and floors, you’d better be prepared to pay for a professional cleaning crew to come in regularly instead of trusting your tenant to wipe everything down after deep-frying chicken for dinner. Same thing for your new, expensive aircon.

Cashflow Planning

When renting out a property, the owner may need to perform some repairs and renovations before leasing it out to tenants. Depending on the condition of the unit, this could range from a simple repainting to a full-scale renovation and purchase of new furniture. If you have problems finding suitable tenants, you will have to hire a realtor and pay their fees (typically half a month’s rent for every year of tenancy) once they get a tenant for you. When your tenants leave, you will have to return the deposit you collected (typically two months, plus one month for every year of tenancy).

Meanwhile, you will continue to make mortgage payments. All these wouldn’t be that much of an issue, but for the fact that your rental income may only just barely cover the mortgage, which means you may have to dip into your own funds! Instead of being the whip-cracking ringmaster, a landlord is more like the circus clown, having to juggle multiple financial commitments just to keep the show going.

Summary

A country like Singapore may provide a conducive environment for real estate investment but the onus of making lucrative investments ultimately rests on the investors themselves.

Potential investors should not jump into investing without having their eyes wide open – ample homework has to be done to correctly identify or anticipate property cycle phases in order not to miss out on Golden Opportunities.

While one should always be ready to answer when Golden Opportunities knock on the door, one should always ensure that he has the financial capability of doing so and be able to discern a Golden Opportunity from one that is merely disguised as such.

Get Direct Developer Prices & Discount on New Condominiums