Last Updated on September 21, 2025 by Editorial Team

Selling your property in Singapore isn’t as simple as finding a buyer and handing over the keys. You’ll also have to consider one important aspect that many miss, and that is the outstanding home loan. Whether you are paying off a mortgage, a bank loan, or an HDB loan, the outstanding amount needs to be sorted out before the sale is complete. Failure to do so can lead to withheld proceeds or IRAS penalties!

In this blog post, we’ll share all you need to know about redeeming mortgages, using bridging loans for simultaneous buy-sell transactions, and managing the legal fees associated with the sale.

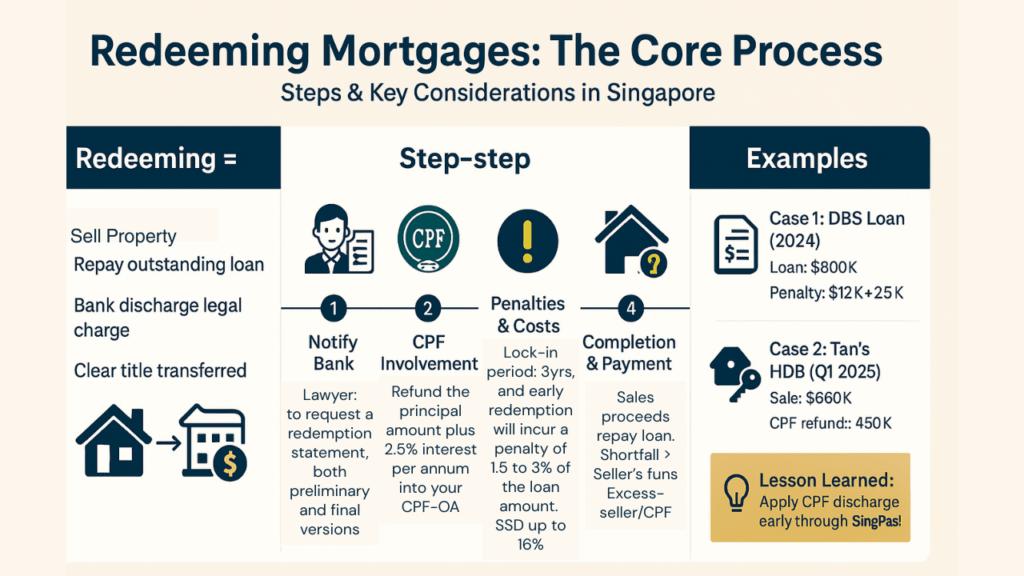

Redeeming Mortgages: The Core Process

Redeeming your mortgage means selling your property, then repaying the outstanding home loan balance, and transferring a clear title to the buyer. In Singapore, this is mandatory at completion, which is about 8 to 12 weeks after the Option-to-Purchase (OTP). The bank will then discharge its legal charge on the property with the Singapore Land Authority (SLA) or HDB.

Here’s a step-by-step guide on how to redeem your mortgage.

Notify Bank – Tell your lawyer to request a redemption statement, both preliminary and final versions. This will show the outstanding principal, accrued interest as of the completion date, and any penalties.

CPF Involvement – If you’ve used your CPF, you’ll need to refund the principal amount plus 2.5% interest per annum into your CPF-OA. Apply through the CPF Board, and it should be processed within five working days. For HDB flats, HDB will have to approve the redemption, and for private properties, the bank will approve it.

Penalties and Costs – Some loans have a lock-in period of one to three years, and early redemption will incur a penalty of 1.5 to 3% of the loan amount. For example, that’ll be S$15,000 on a million-dollar loan. Clawback of subsidies like legal fee rebates will apply. There is no capital gains tax to deal with, but if you have the property for under four years, you’ll have to pay the Seller’s Stamp Duty (SSD), which is up to 16% depending on how long you’ve had the property.

Timeline and Payment – On completion day, the sales proceeds will settle the loan. Any shortfalls require your personal funds, and excess funds go to you or your CPF.

Here’s an example to illustrate penalties.

According to a report by PropertyGuru, in a 2024 sale, a seller redeemed an $800,000 DBS mortgage, facing $12,000 penalties for early exit and $2,500 in legal fees. The sale price of $1.2m covered it, plus $397,500 was refunded to CPF.

Here’s another example.

Tan sold his OCR HDB flat that he purchased in 2018 in Q1 2025 for $650,000. The outstanding loan, funded by CPF, is $400,000. Redemption required refunding the $400,000 + $50,000 interest to CPF. However, an incomplete CPF application held back completion by 2 weeks and cost $1,000 in buyer penalties.

The lesson?

Apply for CPF discharge early through SingPass!

Bridging Loans: Bridging the Gap Between Sale and Purchase

Bridging loans are meant to help your financial flow during a simultaneous buy-sell transaction. They provide short-term financing of a maximum of six months, as mandated by the Monetary Authority of Singapore (MAS). This will help you cover your down payment or shortfall. They are interest-only and secured against your existing property, and you must pair it with a new home loan.

Interest rates are currently at 5 to 6% per annum, and differ depending on the bank. For example, DBS offers 4.25% plus spread, while Standard Chartered is at SORA + 2.5%. You can get a loan for up to 25% of the new property price or the sales proceeds from the old property, whichever is lower.

Types:

Capitalised Interest – Interest accrues and is added to the principal, and you’ll repay the whole sum after the sale. This is ideal for cashflow relief, as you don’t have any monthly payments until you sell your old property.

Simultaneous Repayment: You’ll pay the interest monthly along with your existing mortgage. With this way, you’ll pay a lower total interest, but have a higher financial burden.

Eligibility – To be eligible for a bridging loan, you have to be a Singaporean citizen, PR, or a foreigner with local property above 21 years old. You’ll need good credit and the Option-to-Purchase for the new property.

Documents: You have to prepare a few documents to apply for the loan. You’ll need the exercised OTP, CPF statements, loan balance, and caveat on the old property.

Costs: There are no processing or prepayment fees, but legal and valuation fees range between $500 and $2,000, while late fees incur a 3 to 5% + 2% penalty.

Repayment – Use your sales proceeds to repay the loan, or you might risk foreclosure on your property. CPF cannot directly repay bridging loans, but refunds after the sale can offset the amount.

Here’s a case study to illustrate a bridging loan taken from a Redbrick Mortgage report.

In 2024, a couple upgrading from HDB to RCR condo (S$1.2M) needed a S$240,000 down payment. They took a S$200,000 capitalised bridging loan from UOB. Their HDB flat was sold in 4 months for S$700,000.

They then used the proceeds to repay the loan plus $6,000 interest. The risk is that if the HDB flat wasn’t sold within the six-month loan period, they would face 5% late fees, which amounts to $10,000. Thankfully, their flat sold early and they could repay the loan in time.

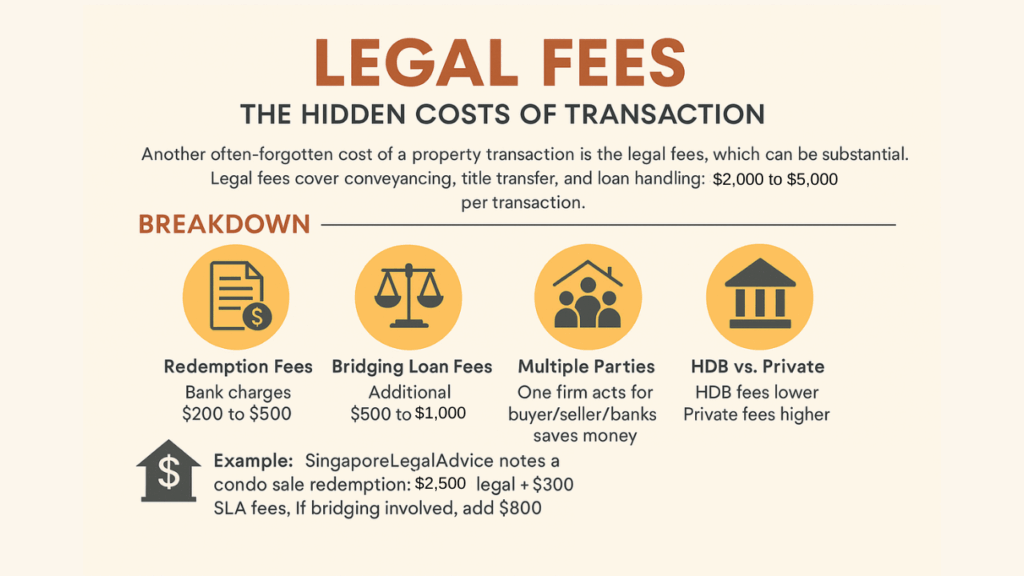

Legal Fees: The Hidden Costs of Transaction

Another often-forgotten cost of a property transaction is the legal fees, which can be substantial. Legal fees cover conveyancing, title transfer, and loan handling. These fees are typically $2,000 to $5,000 per transaction. For sales, the fees are $1,500 to $3,000 base rate plus any additional disbursements, like $500 for searches or stamps. You can use your CPF funds for legal fees if they are property-related.

Breakdown:

Redemption Fees – Bank charges $200 to $500 for discharge documents.

Bridging Loan Fees – Additional $500 to $1,000 for setup and conveyancing.

Multiple Parties – If refinancing/selling, one firm can act for buyer/seller/banks to minimize costs (e.g., $3,000 total vs. $6,000 separate).

HDB vs. Private – HDB fees lower ($1,000-$2,000), private/landed higher due to SLA lodgments.

Example: SingaporeLegalAdvice notes a condo sale redemption: $2,500 legal + $300 SLA fees. If bridging is involved, add $800.

Here’s a recent case study.

Ms. Lim sold her inherited CCR condo for two million in 2025, while buying a new one, using a $400,000 bridging loan. The legal fees incurred for conveyancing, sale, purchase, and loan were $4,500. The old 1.2 million mortgage had a two-year lock-in period, so Ms. Lim will have to pay $18,000 in penalty fees.

The interest on the bridging loan was $12,000 over 5 months, and the total cost was $34,500 (legal + penalty + interest). This cost was deducted from the sales proceeds, and she saved $1,000 by using one lawyer for all the transactions. A delay in the probate for an inherited property added a further $2,000 in holding costs.

Risks, Strategies, and Market Ties

Risks – According to Cushman & Wakefield, a market slowdown could delay sales, extending bridging periods and increasing the penalty fees incurred. Rising interest rates from 1.92% could further inflate costs.

Strategies – Get pre-approval, list the old property early, and use tools like SRX for valuations. In 2025’s pent-up demand post-global uncertainty, quick redemptions will enable upgrades amid a 3 to 5% price increase.

Consult professionals – Engage CEA-licensed agents and lawyers early. Check CPF, IRAS, and banks for shifting policies, which will ensure smooth transitions in Singapore’s highly-regulated market.