Last Updated on September 17, 2025 by Editorial Team

As of September 2025, Singapore’s private residential property market continues to show its resilience despite global economic uncertainties like trade tensions and volatility with interest rates. According to the Urban Redevelopment Authority (URA), private home prices rose 1% quarter-on-quarter in Q2 2025 and 0.8% in Q1, accounting for the 1.8% increase for the first half of 2025.

A recent HSBC-Savills webinar highlighted a 56% cumulative price increase from Q2 2017 to Q2 2024, and for the first half of 2025, forecasts indicate a growth of 3 to 5% for the full year, according to CBRE and Savills projects. This is driven mainly by a controlled supply, strong local demand, and other demographic factors like wealth transfers by the baby boomers.

However, buyer caution may lead to a slight decrease in transaction volumes, and as Cushman & Wakefield notes, potential declines could be caused by elevated interest rates and changing policy measures.

In this blog post, we’ll analyze key trends, statistics, and market drivers for the Singapore private residential property market in the second half of 2025.

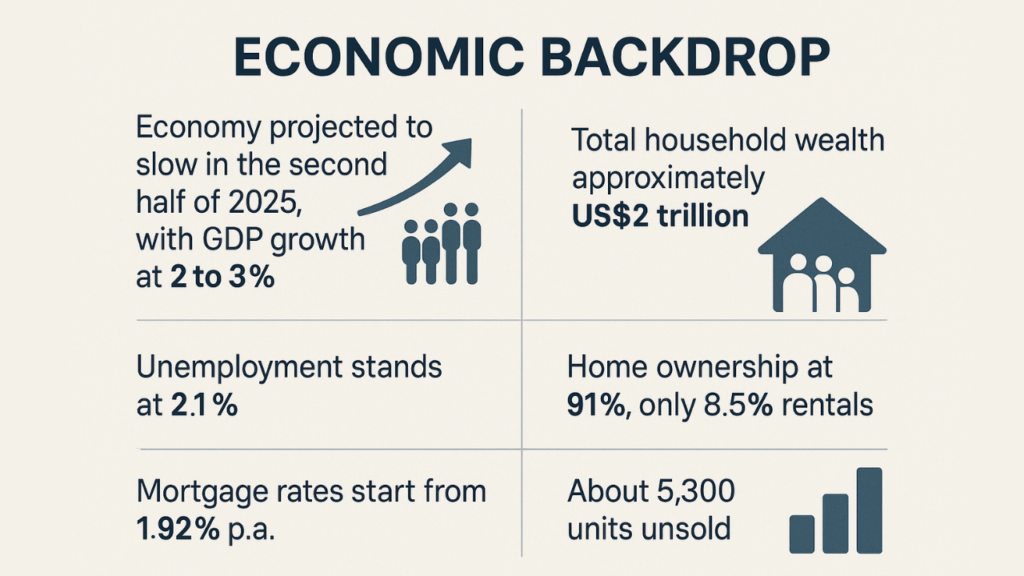

Economic Backdrop

While Singapore will not enter a recession, the economy is projected to slow in the second half of 2025, with GDP growth at 2 to 3%. This is down from the initial estimates due to global events like the US-China trade disagreements. Unemployment stands at a mere 2.1%, which bodes well for household spending and demand for property.

Total household wealth stands at approximately US$2 trillion from the population of 6.04 million and 1.46 resident households. Home ownership stands high at 91%, and only 8.5% of homes are rentals, supporting the cultural emphasis on using property as a wealth preservation tool.

A critical factor is the stable, but elevated interest rates, as mortgage rates start from 1.92% per annum for floating packages pegged to SORA, the Singapore Overnight Rate Average, as offered by banks. A downtrend in rates could increase demand, but as of now, current levels limit affordability for many buyers.

Despite this, liquid assets per household have outpaced the price growth of property, making private residences relatively affordable for top-income brackets. CBRE notes that about 5,300 units as of mid-2025 remain unsold, a relatively low number.

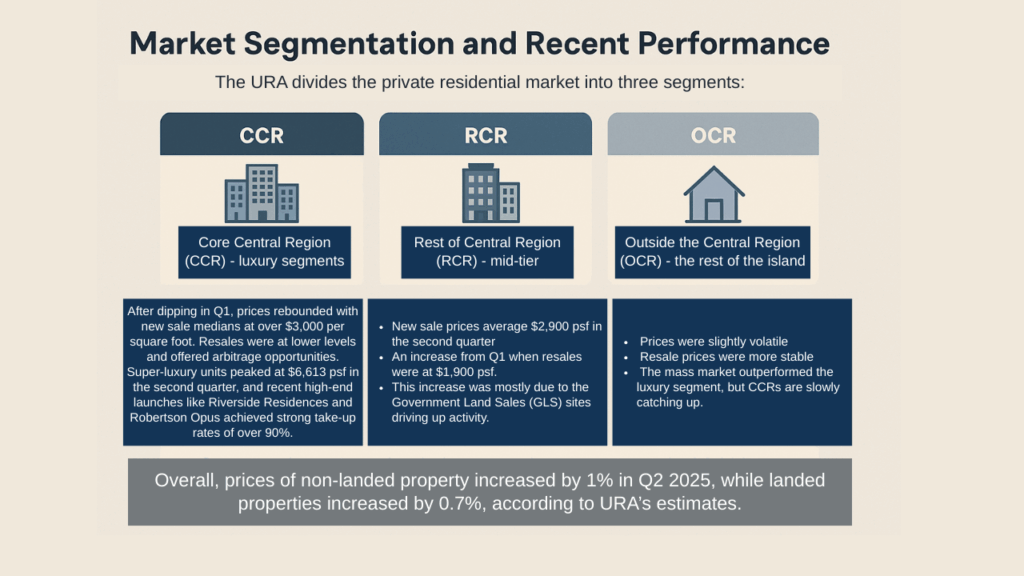

Market Segmentation and Recent Performance

The URA divides the private residential market into three segments:

Core Central Region (CCR) – luxury segments, Districts 1, 2, 4, 6, 7, 9, 10, 11, and Sentosa

Rest of Central Region (RCR) – mid-tier, Districts 3, 5, 8, 12, 13, 15, 20, and city fringes

Outside the Central Region (OCR) – mass market, the rest of the island

In the first half of 2025, the prices and performance of each segment varied significantly.

CCR – After dipping in Q1, prices rebounded with new sale medians at over $3,000 per square foot. Resales were at lower levels and offered arbitrage opportunities. Super-luxury units peaked at $6,613 psf in the second quarter, and recent high-end launches like Riverside Residences and Robertson Opus achieved strong take-up rates of over 90%.

RCR – New sale prices average $2,900 psf in the second quarter, an increase from Q1 when resales were at $1,900 psf. This increase was mostly due to the Government Land Sales (GLS) sites driving up activity.

OCR: OCR prices were slightly volatile, especially in distant locations, and new sale prices were fluctuating but trending up. Resale prices were more stable, and the mass market outperformed the luxury segment, but CCRs are slowly catching up.

Overall, prices of non-landed property increased by 1% in Q2 2025, while landed properties increased by 0.7%, according to URA’s estimates.

Sales Trends and New Launches

URA’s regulation of the land supply continues to minimize oversupply risks, and new launches closely track sales. In 2024, new sales hit record highs, with projects like one in the Japanese area selling 94% at peak prices. In the first half of 2025, there were moderated volumes, and Cushman & Wakefield predicted a slight decline for the second half of 2025, amid buyer caution.

Here are some specific examples.

- Projects with proximity to MRT stations or with unique qualities achieved over 90% take-up. For example, rentals near the Science Park are popular with tech workers.

- Mediocre sites sold at 30 to 40%, highlighting the importance of location.

- Sub-sales, which is flipping the property before completion, have dropped sharply due to the Seller’s Stamp Duty (SSD) extension in July to four years instead of three, making flips less profitable.

- New sales refer to off-plan or unregistered projects, while resales include completed units sold by developers after registration.

- Transactions are still dominated by locals, and foreign buys remain minimal.

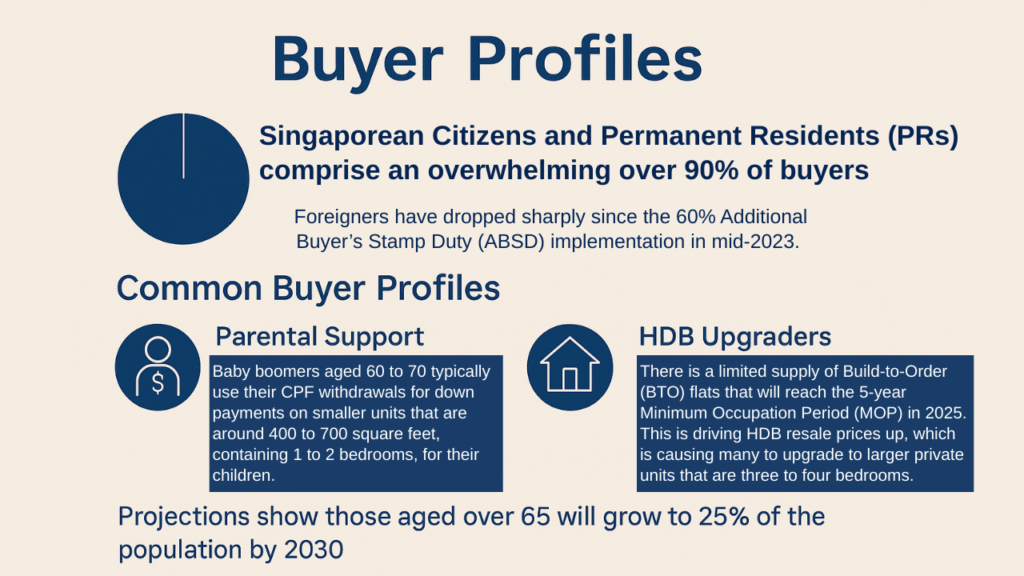

Buyer Profiles

Singaporean Citizens and Permanent Residents (PRs) comprise an overwhelming over 90% of buyers, with foreigners dropping sharply since the 60% Additional Buyer’s Stamp Duty (ABSD) implementation in mid-2023. Among the foreigners that purchased property, Chinese buyers hover at 29 to 31%, and Malaysians and Indians trail behind.

Here are some common buyer profiles.

Parental Support – Baby boomers aged 60 to 70 typically use their CPF withdrawals for down payments on smaller units that are around 400 to 700 square feet, containing 1 to 2 bedrooms, for their children.

HDB Upgraders – There is a limited supply of Build-to-Order (BTO) flats that will reach the 5-year Minimum Occupation Period (MOP) in 2025. This is driving HDB resale prices up, which is causing many to upgrade to larger private units that are three to four bedrooms.

Projections show that those aged over 65 will grow to 25% of the population by 2030, sustaining wealth transfers, while the 50 to 65 age group will increase through 2050, fueling demand.

Price Volatility and Forecasts

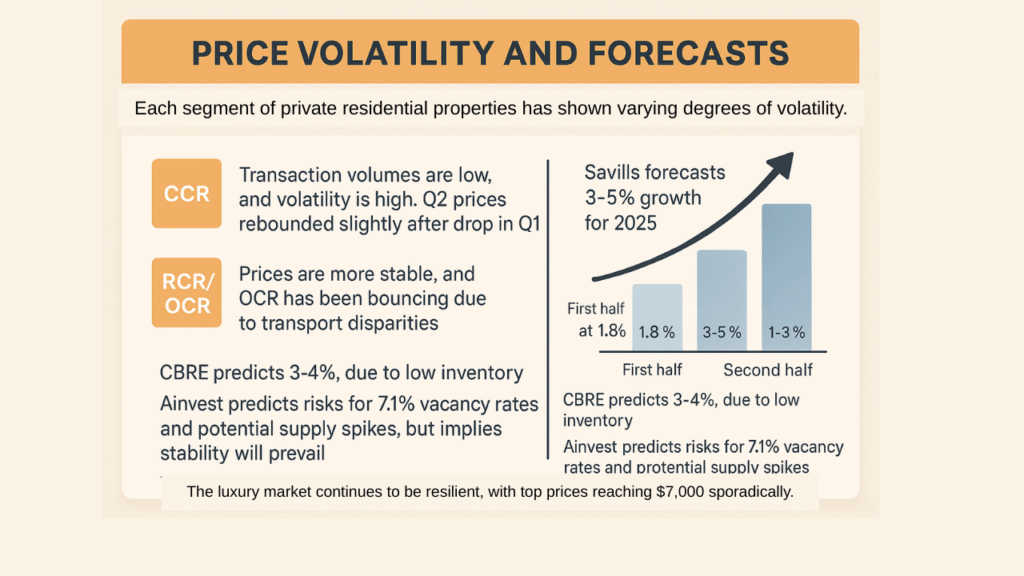

Each segment of private residential properties has shown varying degrees of volatility.

CCR: Transaction volumes are low, and volatility is high. Q2 prices rebounded slightly after the drop in Q1.

RCR/OCR: Prices are more stable, and OCR has been bouncing due to transport disparities.

Savills forecasts a 3 to 5% growth for 2025, with the first half at 1.8% and the second half predicted at 1 to 3%. CBRE predicts 3 to 4%, due to low inventory. Ainvest predicts risks for the 7.1% vacancy rates and potential supply spikes, but implies stability will prevail. The luxury market continues to be resilient, with top prices reaching $7,000 sporadically.

Future Supply and Leasing Market

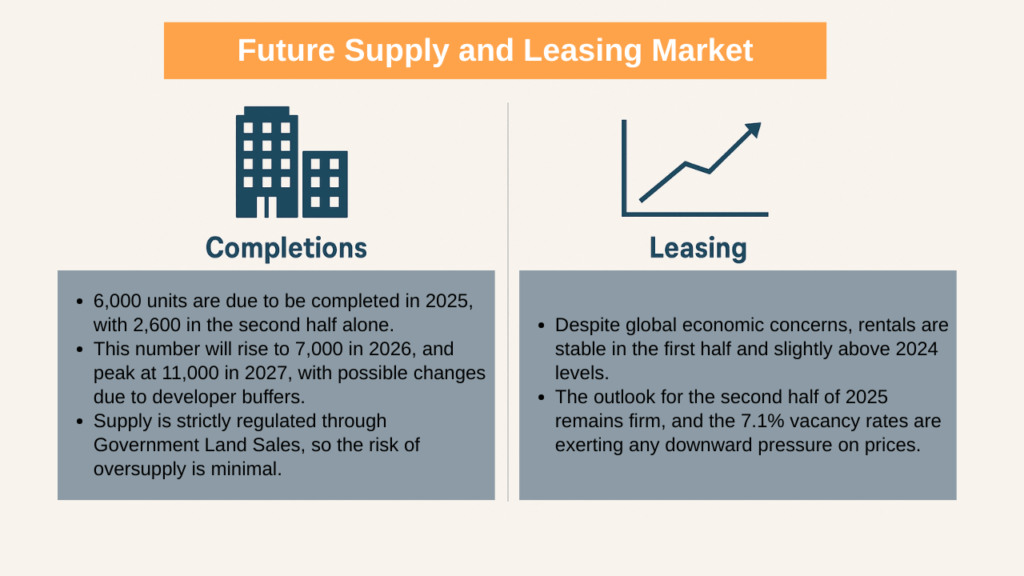

Completions – 6,000 units are due to be completed in 2025, with 2,600 in the second half alone. This number will rise to 7,000 in 2026, and peak at 11,000 in 2027, with possible changes due to developer buffers. Supply is strictly regulated through Government Land Sales, so the risk of oversupply is minimal.

Leasing: Despite global economic concerns, rentals are stable in the first half and slightly above 2024 levels. The outlook for the second half of 2025 remains firm, and the 7.1% vacancy rates are exerting any downward pressure on prices.

Key Market Drivers

Baby Boomer Liquidity – The top 20% income bracket holds wealth for double-digit growth years, where liquid assets grew faster than prices, facilitating wealth transfers.

HDB Dynamics: The low number of MOP completions in 2025 is creating scarcity, pushing HDB prices up, and creating a demand for upgrades to private housing.

Location and Attributes: Projects with easy MRT access or new and upcoming areas excel. For example, high-demand locations can achieve 94% sell-out.

Resilience to Global Risks: Singaporeans view property as an investment, and demand continues to grow despite trade wars, unlike many other, more reactive markets overseas.

Government Policies and Cooling Measures

Some of URA’s recent regulations prevent free-market excesses. Here are some of the key measures.

60% ABSD on foreigners (2023) – Significantly reduced foreign demand.

SSD extension to 4 years (2025): Reduced flipping properties before completion.

There are no new measures expected in the second half of 2025, as the government pauses post-recalibration, given strong launches.

These measures stabilize prices without suppressing local demand, and without them, prices could have rivaled the Hong Kong real estate surges.

Risks and Challenges

Interest Rates – Delays in the interest rate cut could delay demand.

Supply Risks – The 35,500 units in the pipeline, according to Ainvest, may pressure vacancies if there is a dip in demand.

35,500 units in pipeline (per Ainvest) may pressure vacancies if demand softens.

Demographic Shifts: Due to the rise of AI, younger buyers aged 40 to 50 face unemployment, potentially reducing their future wealth.

Global Uncertainties: Continuing trade conflicts may indirectly affect buyer caution, although residential demand is locally insulated.

In the second half of 2025, Singapore’s private residential property market is set to enjoy steady, moderate growth due to demographic drivers, limited supply, and political stability. With prices rising 1.8% in the first half and forecasts of 3 to 5% for the rest of 2025, opportunities are present in the RCR and OCR segments for value, and CCR is showing strong signs of rebound in the luxury sector.

Buyers should prioritize location and monitor prices, as demand from HDB upgraders and parental transfer of wealth could rise if the conditions are optimal. This controlled ecosystem creates incredible resilience in Singapore’s real estate market, despite global volatility.