Last Updated on September 21, 2025 by Editorial Team

Selling your condo in 2025 isn’t quite what it used to be. Singapore’s dynamic real estate landscape is constantly shifting, and between cooling measures, changing legislation, and the government’s ever-watchful eye on the property market, it can be difficult to determine exactly when and how to sell.

That’s why we’ve created this handbook. This is a comprehensive guide to all you need to know when selling your condo in 2025. From calculating financials to government regulations, we’ll share all you should know so you can maximize your returns from your investment and walk away a happy seller.

Now that you’ve decided to put your property on the market, here’s a comprehensive list of things you should consider.

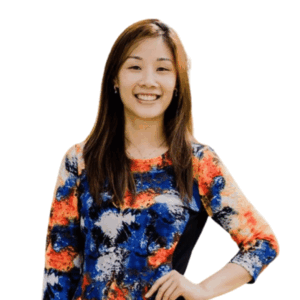

Step 1 – Check Payable Seller’s Stamp Duty (SSD)

On 4 July 2025, the government changed a few policies, and here they are.

Key 4 July 2025 SSD Changes:

- Holding period extended to four years from the date of purchase

- Top rate increased to 16% (from 12%) for sales under a year, with graduated reductions

- Exemptions remain unchanged for inheritance, divorce, or corporate restructurings (requires IRAS approval)

These changes were implemented in efforts to curb short-term speculation and promote long-term ownership amid rising interest rates and cooling measures.

You are eligible to sell your condo any time after purchase, BUT! You are liable to pay the SSD (Seller Stamp Duty) if you sell within four years. The SSD ranges between 4% and 16%, which makes a sizeable amount of S$40,000 to $160,000 if the condo is sold for a million dollars.

The SSD is calculated based on either the selling price or market value, whichever one is higher, so as to prevent under-declaration. The old 3-year rule still applies to properties bought before 4 July.

Updated SSD Rates Table (Effective July 4, 2025)

Holding Period from Purchase Date | SSD Rate (%) | Basis of Calculation |

Up to 1 year | 16% | On full selling price or market value (whichever higher) |

More than 1 year and up to 2 years | 12% | Same as above |

More than 2 years and up to 3 years | 8% | Same as above |

More than 3 years and up to 4 years | 4% | Same as above |

More than 4 years | 0% | N/A |

Calculating the SSD

If the market value, as assessed by IRAS, is higher than your selling price and your property is undervalued, the higher figure is used. For example, if you sell at $1.5 million but IRAS values it at $1.55 million, the SSD is calculated on $1.55 million.

SSD Calculation Case Studies

Let’s take a look at how the SSD can potentially impact your property sale price. For simplicity’s sake, we’ll assume the market value equals the selling price.

Property sold under a year – You bought a condo for $1.2 million in August 2025 and sold it for $1.3 million in June 2026. At an SSD rate of 16%, you are liable for $208,000 in tax, which, as you can see, wipes out your profit.

Property sold in 18 months – You bought a $1.5 million condo in September 2025, selling it for $1.6 million in March 2027, making your holding period 18 months. This falls under the 12% SSD rate, and that’s $192,000 of tax.

Property sold in 3.5 years – Bought for $2 million in July 2025, sold at $2.2 million in January 2029. Holding periods, 3.5 years, and at an SSD rate of 4%, your tax amounts to $88,000.

Checking Your SSD Tax Payable

You can calculate it manually or you can use the IRAS Stamp Duty Calculator myTax Portal. Input purchase date, selling price, and details and you’ll get your SSD, which you should factor in before deciding when to sell your property.

Should I Sell My Property Within Four Years?

Unless the sale of your condo promises a profit that can cover the SSD tax and all the other expenses, like agent fees, it might make more financial sense to hold it for at least four years.

If you’re unsure about whether to start selling your condo or you’d like to chat more, we’re here to help. No pressure, no hard sell, but just a friendly chat for us to understand your needs and help you along. Good luck!

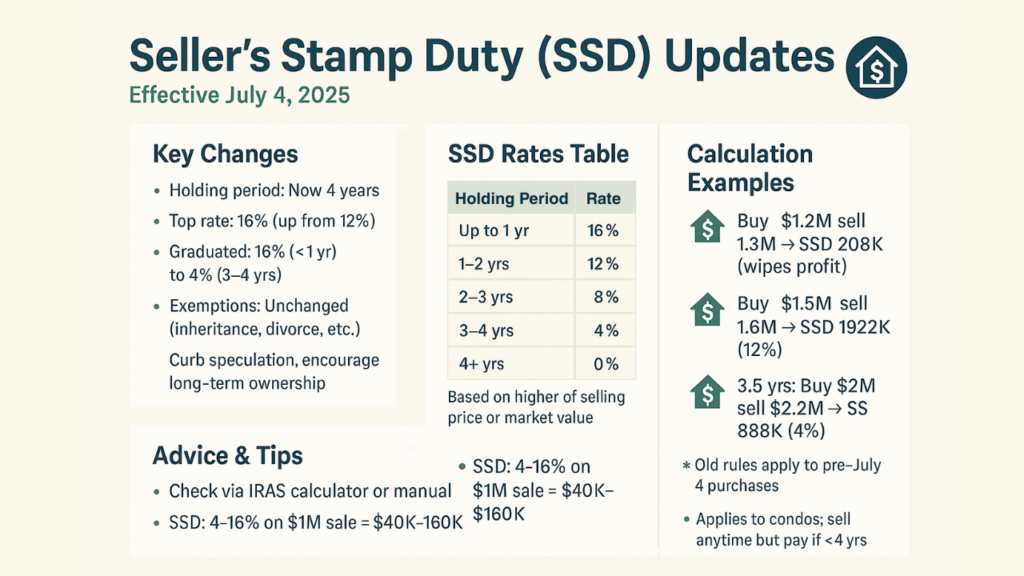

Step 2 – Mortgage or Loan Review Before Selling Your Condo

For the next time, you’ll have to check your outstanding loan balance, understand any lock-in periods and penalties, serve the required redemption notice, and plan for CPF refunds if you’ve used your CPF for your property.

In Singapore, most banks require a structured redemption process, typically handled by a lawyer, to discharge the mortgage upon the sale completion. Failure to do so can lead to cash shortfalls or delays in the transaction.

Let’s take a closer look at each factor.

Outstanding Loan Balance

You need the latest redemption statement that outlines the principal loan remaining, accrued interest, and any other fees. This number is crucial as the proceeds from your property sale must first settle this. You can get this number by contacting your bank or checking your account online.

Lock-in Periods and Penalties

Many banks have a two or three-year lock-in period for home loans, and early redemption due to sales will incur penalties. The standard penalty is 1.5% of the outstanding loan amount plus administrative fees that range from $200 to $500. Some loan packages might waive sales, and you don’t have to pay any penalties if you redeem outside the lock-in period but to be safe, always check with your bank.

Redemption Notice Period

Banks usually require two months’ written notice for redemption, or payment of two months’ interest to compensate for their lost interest. This starts from the notice date to the intended redemption date, which is usually the date of your sale.

CPF Refunds with Interest

If you’ve used your CPF-OA or CPF-SA for your property, whether it is the downpayment, instalments, or stamp duties, you’ll need to refund the amount you’ve withdrawn, plus all the accrued interest, which is pegged at 2.5% p.a. For OA and 4% for SA.

This accrued interest is what the funds would have earned in CPF if you didn’t use them for your property. Refunds go back to your CPF accounts, and if proceeds are insufficient, no cash top-up is required, but it would have caused an overall reduction in your CPF funds.

For sellers above 55, any excess may go to your Retirement Account.

Why The Outstanding Loan Matters For Your Condo Sale

The outstanding loan, any penalties, CPF refunds, agent and legal fees, and any SSD or other taxes must be taken into account when calculating your net profit. The sales price may be misleadingly high, but when you take all these factors into account, it could significantly impact your profits.

Review all these factors before deciding if switching loan packages with the same bank or refinancing with another bank makes sense before selling, potentially lowering rates without full redemption.

Step 3 – Detailed Financial Breakdowns and Net Proceeds Calculation

Depending on why you’re selling your condo, you’ll have to factor in other cost considerations and plan the timing of the sale. For example, if you are looking to move to another place, you’ll have to factor in the rental cost after the sale of your current property and before you move into the new one. You’ll also need to align the timeline for receiving sales proceeds, any CPF reimbursements, and payment dates for your new property if both transactions are done back-to-back. A common mistake that sellers often make is overlooking the fact that proceeds from their condo sale have to go into repaying the outstanding home loan. This could result in a serious cash shortage as the new property will require a down payment.Calculating Net Proceeds

Calculating your net proceeds from selling your condo is crucial to planning your finances, especially when selling your condo in 2025 with updated cooling measures and higher costs. A quick look at the formula is: Net Proceeds = Expected Sale Price – (Outstanding Loan + CPF Refund + Agent Commission + Legal Fees + SSD + Other Costs) This formula accounts for all cash outflows, and you can calculate it accurately using online tools from IRAS, CPF, or banks. Be precise, as the slightest miscalculation could land you in financial problems.Itemised Costs of Selling Condo Breakdown

To illustrate what we mean, here’s a table of typical costs associated with selling a $1.5 million condo in 2025, excluding GST and using rates as of August 2025.| Cost Category | Description | Estimated Amount | Notes |

|---|---|---|---|

| Outstanding Loan | Principal + accrued interest to redemption date. | Varies depending on the loan amount (e.g., $800k remaining) | Includes early redemption penalties if within lock-in (1.5% of loan + $200–$500 admin fees). |

| CPF Refund | Principal withdrawn + accrued interest (2.5% p.a. OA, 4% p.a. SA). | $200k principal + $20k interest (over 4 years) | Mandatory refund to CPF accounts; no cash top-up needed if proceeds cover it. |

| Agent Commission | Fee for marketing and closing the sale. | 2% of sale price ($30k for $1.5M) + 9% GST ($2.7k) | Negotiable; ranges 1–4% for condos, often 2% standard. Paid at completion. |

| Legal/Conveyancing Fees | Lawyer handles discharge, contracts, and CPF. | $2,000–$3,500 | Fixed range for private properties; includes stamp duties processing. |

| Seller’s Stamp Duty (SSD) | Tax if sold within 4 years (2025 rules). | Up to 16% on sale price (e.g., $192k for $1.5M sold after 18 months) | See SSD section for details; payable within 14 days of OTP. |

| Other Costs | Property tax proration, MCST fees, admin (e.g., valuation $500), moving/repairs. | $1,000–$5,000 | Prorate taxes/fees to completion date; early redemption notice interest (2 months’ if short). |

Step 4 – Conduct Market Research To Determine Selling Price

Next, you’ll have to determine your asking price. Conduct some online market research and get some recently transacted prices of other similar condos in your area. This will give you a realistic price range so you can keep the pricing competitive when you put your property on the market. Alternatively, engaging a reputable real estate agent who specializes in selling private properties can also give you some solid advice. Experienced agents well-versed in market trends will know how to use Comparative Market Analysis (CMA) to help determine your property’s market value.Understanding Comparative Market Analysis (CMA)

A Comparative Market Analysis (CMA) is a professional evaluation that compares your condo to similar properties that are sold, listed, or unsold in nearby developments. In Singapore’s 2025 resale market, shaped by moderating inflation and cooling measures, a strong CMA sets a competitive price to attract buyers and maximize returns. Unlike simply using online research, CMA adjusts for subtle differences to prevent overpricing, which means your property will have difficulty selling, or underpricing, which translates to lost profits. Agents can also draw from official URA transaction data and combine it with on-site insights for optimal accuracy.Key Factors Considered in a CMA

In addition to location and size, here are other variables that CMAs evaluate.| Factor | Description | Impact on Pricing |

|---|---|---|

| Unit Size and Layout | Built-up area (sq ft/m), bedrooms/bathrooms, floor plan efficiency. | Larger, efficient units premium 10–15%; e.g., 1,000 sq ft 3-bedder vs. cramped one. |

| Floor Level | Higher (e.g., >10th) vs. low/mid; penthouses/ground unique. | High floors +5–10% for views/privacy; low floors discount for noise. |

| Facing and Orientation | North-south (cooler) vs. east-west (hotter); unblocked views (sea/city/greenery). | Preferred facings +3–8%; west-facing lower due to heat. |

| Renovations and Condition | Upgrade quality (kitchen/flooring/smart features) and maintenance. | High-end renos ($50k+) +5–15%; outdated −10%. |

| Age and Lease Tenure | Age (<10 vs. 20+ years); remaining lease (70+ years ideal). | Newer freehold/999-year +20–30% over aging leaseholds. |

| Proximity to Amenities | To MRT/schools/malls/parks; condo facilities (pool/gym). | Prime spots (e.g., CBD/Orchard) +15–25%. |

| Market Trends | Sales velocity, inventory, days on market, 2025 indicators (interest rates). | Buyer’s market: −5–10%; reference URA reports. |

Disadvantages of Relying Only on Online Portals

Popular portals like PropertyGuru, 99.co, and EdgeProp are great resources, but they only show asking prices, which are about 5 to 15% higher than the actual transacted price. They also often have outdated or unverified data, which ignores off-market deals. For accuracy, always use URA’s free portal or the SRX-X-Value tool. Over-reliance on these online portals might give you unrealistic expectations, and if you price your property too high, you might have difficulty selling.The Role of Agent On-Site Assessments

In addition to the CMA, have your agent inspect your property in person, which might uncover unique features like the views from your property or custom built-ins, which can add a 5 or 10% premium. They will know what buyers want, and can advise you accordingly.

Step 5 – Full Transaction Timeline for Selling Your Condo in 2025

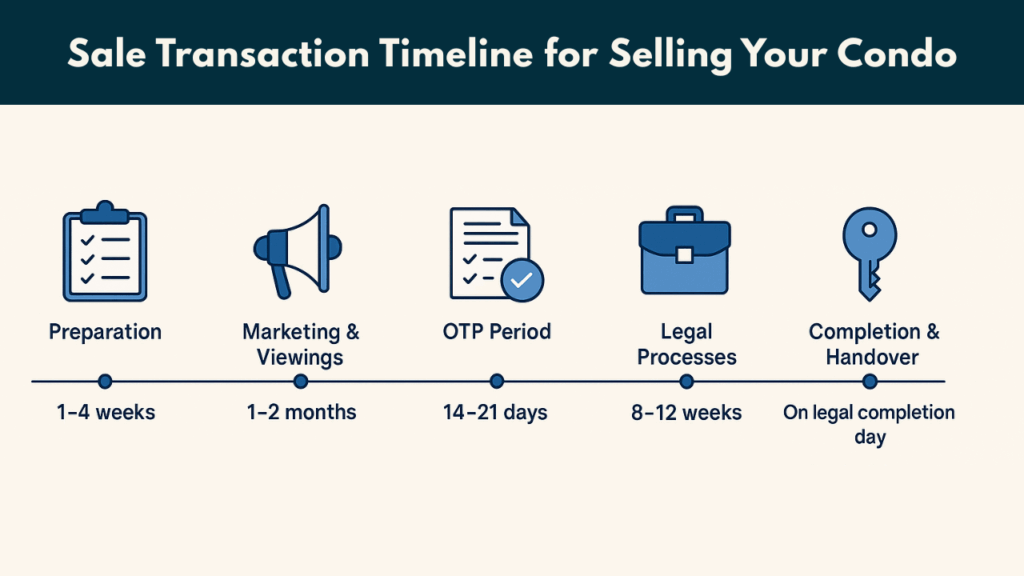

Depending on your asking price, market demand, and preparation, the average time that it’ll take to sell your condo is three to four months from listing to completion. Here is a breakdown of a rough timeline.| Phase | Duration | Key Milestones |

|---|---|---|

| Preparation | 1–4 weeks | Check SSD (updated July 4, 2025: 4-year hold, up to 16% rate), review loan/CPF, value condo via CMA, select agent, stage for visuals. |

| Marketing & Viewings | 1–2 months | Develop strategy (photos/videos, portals like PropertyGuru, social ads on Instagram/TikTok), conduct viewings, negotiate offers. |

| OTP Period | 14–21 days | Issue OTP (1% fee), buyer exercises with +4% deposit (total 5%), binding deal; verify buyer IPA to cut risks. |

| Legal Processes | 8–12 weeks | Lawyer handles SPA, loan redemption, CPF refunds, fees (MCST/tax), title transfer; coordinate for concurrent buy/sell. |

| Completion & Handover | On legal completion day | Funds disbursed, ownership transferred, return keys/cards; ensure clean handover to avoid disputes. |

Step 6 – Choosing the Right Agent for Selling Your Condo

Hiring the right agent can make all the difference, as each one has their own strengths and weaknesses. Hiring one that specializes in private properties can help with tedious things like marketing, paperwork, conducting viewings, and monitoring the timeline till completion. A good agent can help you sell your property with minimal work from you.

More importantly, a good agent can help get the best price, minimize the time that your property is on the market, and handle negotiations. Commissions will range from 2 to 4% of the sale price, and add GST on top of that.

Key Agent Selection Criteria

Some factors to consider when selecting your agent are:

Track Record – Review past sales in your district/condo type, success rates (e.g., days to sell, % of asking price), testimonials, and references. Agents with multiple condo sales close faster at higher prices, indicating reliability.

Market Knowledge – Assess condo expertise (vs. HDB/landed), local 2025 trends (post-ABSD shifts), CMA pricing, CEA license, and experience. Specialists manage nuances like lease decay/amenities, avoiding mispricing in areas like District 9/10.

Marketing Strategy – Ask for detailed plans on how the agent would go about listing your property. Ideally, digital marketing efforts will have photos, videos, and listings on property portals. Strong marketing can dramatically reduce the time it takes for your property to sell and increase the final sale price.

Communication and Responsiveness – Good responsiveness and communication build trust, and an agent that fails to answer or return phone calls does not instill confidence.

Negotiation: A skilled agent is an expert negotiator, both in securing the best price for your condo as well as resolving conflicts. In addition, check CEA compliance and ensure no hidden dual representation.

Red Flags to Watch For In Agents

Here’s what to look out for when choosing which agent you DON’T want!

- No Valid CEA License: All agents must be registered; check via the CEA Public Register app/site—unlicensed practice is illegal.

- Pushy or Vague Tactics: Pressure to sign exclusive agreements quickly, or a lack of marketing plans and references.

- Poor Online Presence/Reviews: Negative feedback on Google, PropertyGuru, or forums about delays, miscommunication, or overpromising.

- Team Delegation Without Oversight: If staff handle most work, ensure the lead agent’s involvement.

Step 7 – Prepare Your Condo for Viewing

You only have one chance to make a good first impression, so make it count. Sure, there is no need to refurbish your condo with the latest interior designs, but you can also stage the visuals of your home very quickly and simply.

Before any viewing, be sure that your property is kept squeaky clean, is cool, and well-lit. Minor repairs like fixing a flickering bulb, tightening loose hinges, or fixing small flaws can make a big difference.

Home Staging Tips

Small tweaks can make a big difference. Here’s a list of things you can quickly do to make your property look more appealing.

- Declutter

- Use neutral decor

- Incorporate plants

- Ensure fresh scent

- Strategically light the place to make it the most flattering

- Stage a spare room as a home office

- Keep the entrance tidy

- Take some awesome photos with professionals who know how to capture the best

How Staging Boosts Offers

When selling your condo in 2025, keep in mind that staging can reduce time on the market by up to 73% and increase offers by 6 to 10%. It has been shown that up to 40% of buyers are likely to visit a staged home that they see online.

This is especially effective for condos with unique layouts or luxury features, appealing to young buyers who value aesthetics. Consider certain trends like minimalism and sustainability as well.

Step 8 – Market Your Property

Once you’ve figured out your finances and spruced up your property, you can start marketing on popular portals such as Propertyguru, 99.co, SRX, and iProperty.

Here are some tips to consider.

Invest in Professional Visuals

A picture is worth a thousand words, and your photos posted online should have one objective: To get potential buyers in for a viewing.

Prioritize high-quality images by hiring photographers for shots emphasizing space, natural light, each room, and any unique features or selling points. Incorporate video walkthroughs and virtual tours to let potential buyers explore virtually before coming in for a viewing.

Explore Other Channels

In addition to property portals, you can also use other channels like social media platforms, holding open houses, or placing a few paid ads based on demographics like age, income, and location.

Step 9 – Sale Negotiation Tips and Securing a Buyer

Effective negotiation is everything when it comes to securing the best deal. Balance competitive pricing with buyer incentives and strategic concessions to close deals quickly and maximize profit.

Evaluate and Respond to Offers

Beyond price, evaluate your potential buyer’s readiness through a loan in-principle approval (IPA) and assess their financial stability to minimize the risk of them backing out. Reject lowball offers politely, but counter with other perks like faster completion.

Try uncovering the buyer’s motivation and building rapport, working together towards a common goal, which is the transaction.

Handle Counteroffers and Multiple Bids

Highlight unique features like high-floor views and recent renovations to justify premiums without alienating buyers. For multiple bids, disclose interest levels transparently and ethically through your agent to foster healthy competition. Know your rock-bottom price from the CMA and financial estimates to avoid emotional decisions.

Maximizing Price Without Scaring Buyers

You can boost final offers by up to 10% by building urgency through limited-time open houses and emphasizing market trends like the rising demand of your district. However, remain flexible to avoid alienating potential buyers and focus on coming to a win-win transaction. Offer incentives like flexible handover dates or prorated MCST fees.

Relying on Your Agent’s Experience

Seasoned property agents can make a significant impact on the negotiation process. From anticipating buyer motivations, reading signals, and timed counters, they can suggest their strategies from past deals and incentives like valuation fees. They can also spot red flags like buyers lacking the IPA, and leverage their networks for off-market boosts to snag you a better offer.

Step 10 – Issue the Option to Purchase (OTP) and Collect Option Fee

Got an offer you’re happy with? That’s great, congratulations.

Now you or your agent can issue the Option To Purchase (OTP) with information like the address, purchase price, and 14-day option period during which the buyer has to exercise the option.

Once you’ve issued the OTP to the buyer, you should be collecting a 1% Option Fee to lock in the deal. Once you’ve collected the fee, you cannot issue another OTP to other prospective buyers.

It is possible for buyers and sellers to negotiate a long option period or a higher option fee, as the final terms in the OTP can be amended as long as agreed upon by both parties.

Additional OTP Details and Clauses

The OTP is a legally binding document that reserves the property exclusively for the buyer during the option period, which is typically 14 days but can be extended. In the OTP, you’ll need to specify any additional clauses for unique situations, such as an extension of stay after completion, inclusion of furnishing, and tenancy handover.

A good practice would be to verify the buyer’s IPA before using the OTP to reduce the risk of backing out.

Step 11 – Wait for the Buyer to Exercise OTP

After the 14-day option period, the buyer should exercise the OTP and pay the balance down payment. Once the OTP is exercised, the buyer must provide another 4% of the purchase price as the Exercise of Option Fee. From this point, you can get your lawyer to take care of the rest.

What Happens If the Buyer Does Not Exercise the OTP

If the buyer fails to exercise the OTP after the 14 days or backs out, the OTP will automatically expire, and you will keep the 1% option fee as compensation. Now, you can relist your property or offer an OTP to another prospective buyer.

Post-Exercise Processes and Legal Completion

Once the OTP is exercised, the total deposit will be 5% of the purchase price, comprising 1% option fee + 4% exercise fee, and the transaction is binding. Your lawyer will then manage the Sale and Purchase Agreement and coordinate with the buyer’s lawyer on vetting documents, handling loan redemptions, CPF refunds, and outstanding fees like property tax or MSCT dues.

Legal completion is typically in 8 to 12 weeks, and will result in fund disbursement, ownership transfer, and physical handover.

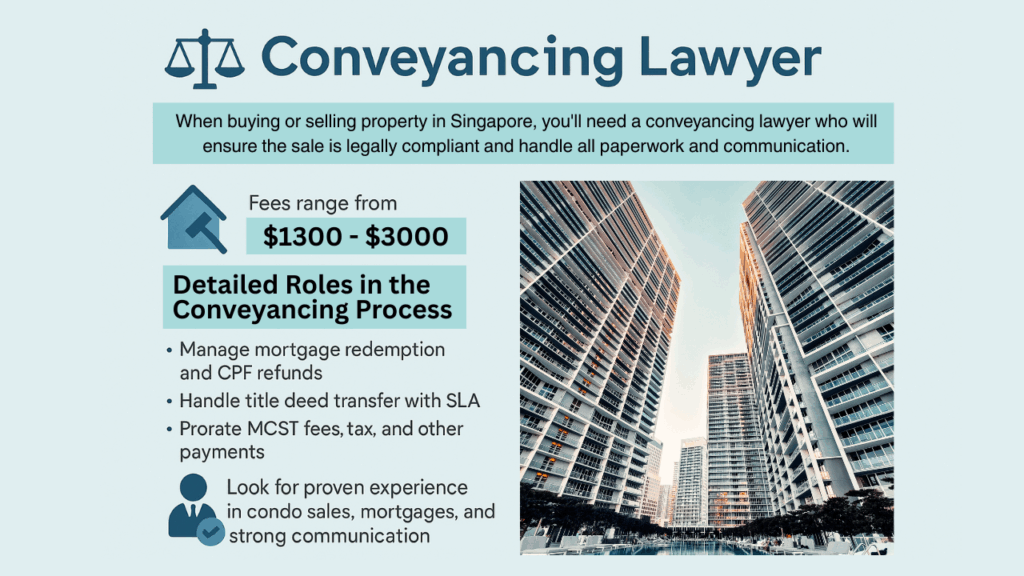

Step 12 – Conveyancing Lawyer

When buying or selling a property in Singapore, you’ll need a conveyancing lawyer, who will ensure the transference of your property to the buyer is done legally and in compliance with all laws. The service will also cover all necessary paperwork and communication with the bank, the buyer, and the buyer’s lawyers.

Naturally, these services will come at a cost. Agent fees range between 2 and 4% of the property transacted price, and conveyancing fees are about S$1,300 to $3,000.

Detailed Roles in the Conveyancing Process

In addition to all the paperwork, your lawyer will manage mortgage redemption by obtaining statements from your bank, coordinating CPF refunds, including the accrued interest, and handling the transfer of the title deed with the Singapore Land Authority (SLA).

Also, your lawyer will take care of any prorating of outstanding payments like MCST fees, property tax, and any parking charges.

Choosing a Conveyancing Lawyer

Selecting a lawyer with proven experience in managing condo sales is vital to having things go smoothly. Choose one that has loads of experience with mortgages, tenancies, and meeting deadlines with authorities. In addition, you might want to look for strong communication and transparent fee structures.

Lawyer’s Role Around OTP

Although it isn’t common practice, you can appoint your lawyer early to review the OTP before it is issued. This is especially useful if your OTP involves special clauses such as an extension of stay, inclusion of furnishing, or tenancy handover.

Once the OTP is exercised, your lawyer will manage the 8 to 12-week process until completion. This includes preparing and coordinating the Sale and Purchase Agreement, ensuring proper fund disbursement, handling loan redemption or CPF refunds, and overseeing the handover.

Step 13 – Complete the Sale With a Final Inspection

From the time the OTP is exercised to the day of completion, which is the handover, you need to maintain the property in the same condition. You can invite the buyer over to conduct a final inspection before the completion date, or once you have moved out.

Finally, hand over your keys to your lawyer for forwarding to the new owners.

Congratulations! Your condo is officially sold!

Legal Completion and Financial Settlements

After the legal completion, there are a few small things you still have to take care of.

Post-Sale Administrative Tasks

Update residential address with ICA via Singpass, notify banks, insurance, telcos, memberships, and subscriptions. Use SingPost’s Mail Redirection Service for seamless mail transition.

Frequently Asked Questions

Typically 3-4 months: 1-4 weeks for prep and marketing (e.g., staging and listings), 2-3 weeks for OTP negotiations, 8-12 weeks for legal completion; delays possible in slow markets or with unready buyers.

On completion day, via cashier’s order for cash portion; CPF refund (principal + 2.5% interest) to Ordinary Account (OA) within 2 weeks.

Legal/conveyancing ($2,000-$3,500), agent commission (1 to 2% of sale price), bank redemption ($200-$500 admin + 1.5% penalty if locked-in), prorated MCST/tax (~$1k-$3k).

Yes, if sold within 4 years post-July 4 (16% <1yr, 12% 1-2yrs, 8% 2-3yrs, 4% 3-4yrs).

3-4 years to avoid SSD; also check mortgage lock-in (usually 2-3 years) for penalties like 1.5% of the outstanding loan.

Sell first to use as a single-property owner, or apply for remission if selling within 6 months (for Singapore Citizen couples); ABSD rates: 20% for 2nd property, up to 30% for 3rd+.

If you’re unsure about whether to start selling your condo or you’d like to chat more, we’re here to help. No pressure, no hard sell, but just a friendly chat for us to understand your needs and help you along. Good luck!

Jae Tan, an award-winning ERA Realty Network agent and speaker at Real Estate Conversations, specialises in buying resale or new launch properties, selling, and renting homes. With multiple Top Achiever awards including The Myst (2025).

Known for sincerity and long-term client relationships, Jae delivers trusted results in Singapore real estate.

Connect with Jae today for your property needs!

Get your Free Property Analysis Report and Seller packages.