Guide to Selling Landed Property in Singapore

Last Updated on September 17, 2025 by Editorial Team

Learn how to sell your landed property in Singapore with our guide. Get tips on financial planning, legal steps, and minimizing costs for a smooth, successful sale.

Selling a landed property in Singapore is a significant decision that requires careful financial planning and legal considerations. Whether you’re upgrading, downsizing, or cashing out, understanding the factors that may impact your sales proceeds and the selling process is crucial for a smooth transaction.

If you’re planning to sell your landed property soon, this guide provides essential information to help you achieve a successful sale while minimizing costs.

Key Factors To Consider

Selling a landed property tends to be more complex than selling a private condo or apartment in Singapore due to stricter regulatory restrictions. Unlike condos, foreigners are not eligible to purchase landed properties unless they obtain approval from the Singapore Land Authority (SLA). This significantly limits the buyer pool compared to private condos, which foreigners can buy without restrictions.

Landed properties typically take longer to sell due to their higher price points compared to HDB flats and private condos. Buyers often conduct more extensive due diligence and valuation processes such as financing planning, legal verifications, and price negotiations. These additional steps naturally prolong the sales cycle.

Transacting a landed property in Singapore typically involves millions of dollars, making it a high-stakes transaction that requires careful handling. With such a significant financial commitment, even minor errors in pricing, documentation, or negotiations can lead to substantial financial losses or legal complications. For this reason, it is recommended to hire a property agent experienced in transacting such properties rather than selling it independently.

Property agents not only help to mitigate risks by providing accurate market valuation but also assist in legal and regulatory compliance, and negotiating favourable terms on your behalf. Their experience and industry knowledge often provide peace of mind, ensuring a smooth and secure sales process.

Types of Landed Property in Singapore

Landed properties are highly sought-after due to their exclusivity and limited supply in Singapore. Unlike owning condos or HDB flats, landed property owners are provided with full ownership of the land and property on which the house sits. They can demolish the house and rebuild it according to their preference as long as it is compliant with guidelines from URA and the Building Construction Authority (BCA).

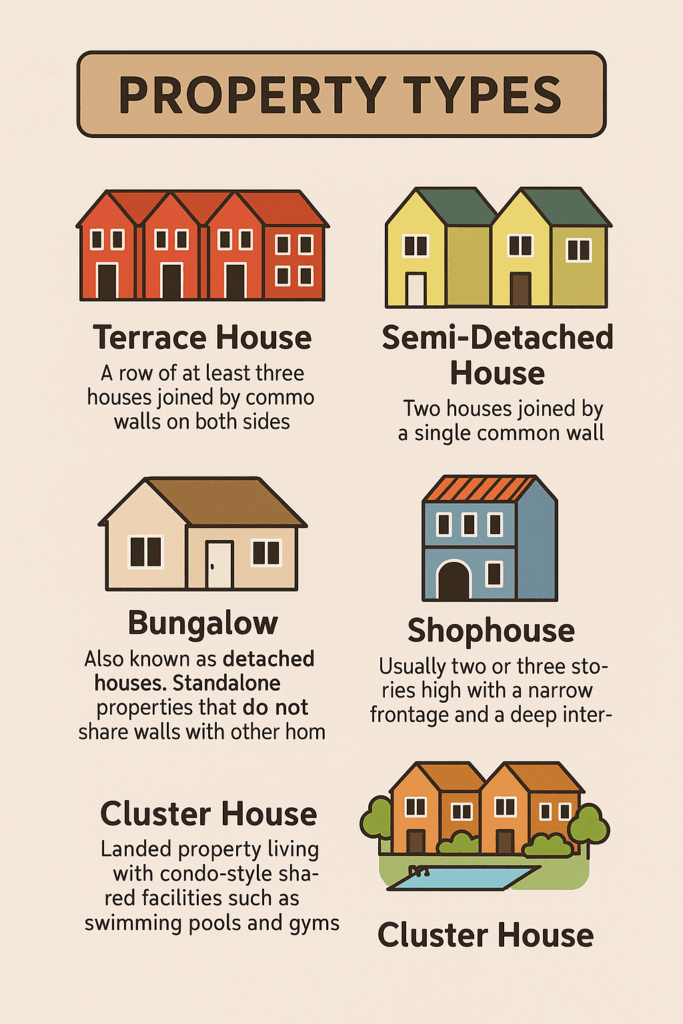

The few types of landed properties that are commonly seen in Singapore include:

Terrace house

| A row of at least three houses joined by common walls on both sides |

Semi-detached house | Two houses joined by a single common wall |

Bungalow

| Also known as detached houses. Standalone properties that do not share walls with other homes

|

Shophouse | Usually two or three stories high with a narrow frontage and a deep interior |

Cluster house | Landed property living with condo-style shared facilities such as swimming pools and gyms |

Unsure about selling or renting out your landed property? Contact us for a friendly, no-pressure chat to discuss your needs.

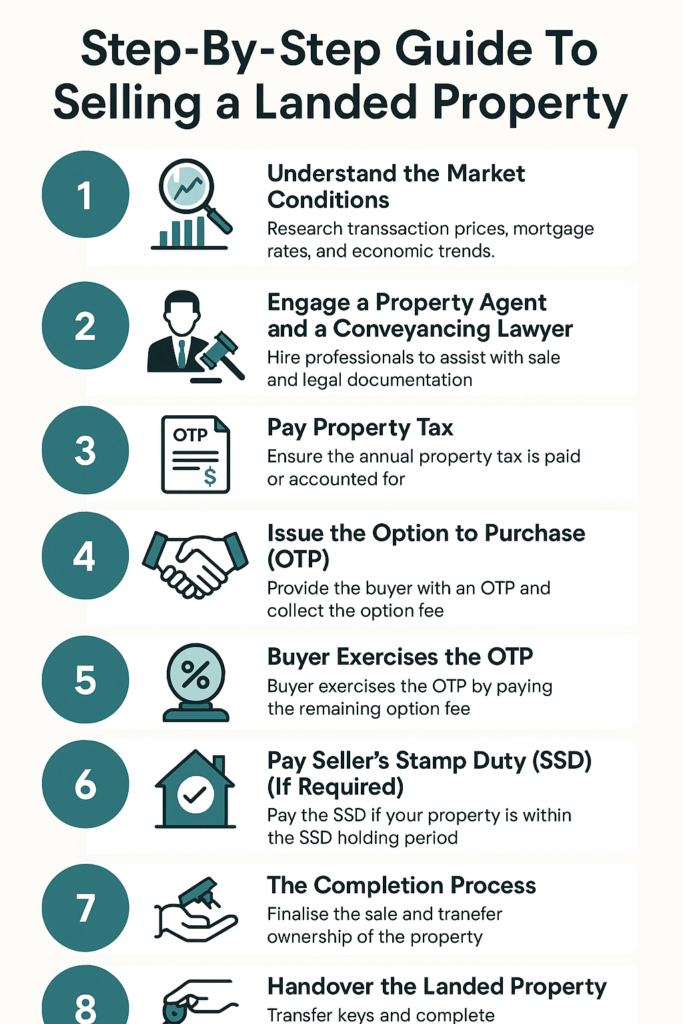

Step-By-Step Guide To Selling a Landed Property

To help you navigate your selling process, here’s a comprehensive guide that breaks down everything from assessing the market condition to the final transfer of ownership to the buyer.

1. Understand the Market Conditions

It is crucial to evaluate the current real estate market in Singapore before setting your asking price. Research recent transaction prices of similar landed properties on platforms like URA’s Real Estate Information System (REALIS), SRX or similar property portals. These sources provide a realistic price range that aligns with buyers’ expectations.

Additionally, keep an eye on mortgage interest rates and economic trends. These factors influence buyer sentiment and purchasing power. Generally, when interest rates are high, borrowing becomes more expensive, leading buyers to adopt a wait-and-see approach. Conversely, lower interest rates reduce borrowing costs, encouraging buyers to make more confident purchasing decisions.

2. Engage a Property Agent and a Conveyancing Lawyer

Engaging a property agent when selling a multi-million-dollar landed property in Singapore is highly advisable due to the complexity, legal requirements, and high-stakes negotiations involved. While it is true that you need to incur some commission fees, having a professional by your side can help you more accurately conduct Comparative Market Analysis (CMA) to set a competitive price, assess current market trends, and market your property to potential buyers.

Hiring a conveyancing lawyer is a must when transacting properties in Singapore. The lawyers serve as the connecting point to various parties involved in the transacting and facilitate necessary paperwork like the Sale and Purchase Agreement and Option to Purchase. They can also identify potential legal issues or risks and ensure the property is free from any encumbrances and complies with local regulations before it is handed over to the buyer.

3. Pay Property Tax

Property tax is an annual tax based on the annual value of the property and property owners are required to make yearly payment in advance by the due date stated in the property tax bill. You can check the AV of your property using the View Property Dashboard on IRAS’ website.

If you have already paid the annual property tax before selling your property and wish to be reimbursed by the buyer, it is important to:

- Inform your property agent and conveyancing lawyer about the advance payment.

- Clearly state this reimbursement in the sale negotiation process and include it as a term in the Option to Purchase (OTP).

- Note that the final reimbursement sum will be prorated based on the completion date of the transaction.

4. Issue the Option to Purchase (OTP)

Once you receive an attractive offer for your landed property, your next step is to issue an Option to Purchase (OTP) to the buyer, a legally binding document granting the buyer the right to purchase the property. If you’ve engaged a property agent, he or she will execute this process on your behalf from now on.

Typically, the buyer has to pay a 1% option fee in cash and exercise the Option to Purchase (OTP) within 14 days (negotiable up to 2 months). If the buyer fails to exercise the OTP within the agreed period, you can retain the option fee and consider new offers from other buyers.

5. Buyer Exercises the OTP

The buyer can exercise the OTP by paying the remaining 4% option fee to your conveyancing lawyer within the agreed option period. This formalises the sale agreement and marks the official start of the selling process.

From this point, your appointed lawyer will take over the transaction and initiate communications with your bank, the buyer and buyer’s lawyer to finalise the transaction.

6. Pay Seller’s Stamp Duty (SSD) (If Required)

If your landed property is within three years of ownership, you’re liable to pay a Seller’s Stamp Duty (SSD) based on the sale price or market value, whichever is higher:

- Less than 1 year – 12%

- 1 to 2 years – 8%

- 2 to 3 years – 4%

- More than 3 years – None

7. The Completion Process

From the date the buyer exercised the OTP, the completion process typically takes 8 to 12 weeks. During this period your conveyancing will assist in:

- Ensuring the buyer pays the remaining 95% of the purchase price.

- Collecting signed legal documents for the official transfer of property ownership.

- Liaising with your bank to redeem the outstanding mortgage loan of the landed property.

On your part, you must ensure all property tax and maintenance fees are paid before the completion date.

8. Handover the Landed Property

Once the completion date arrives and full payment is received, the final step is handing over the property. There are a few things to do to complete the transaction:

- Move out of the property and restore the premises to the agreed condition.

- Conduct a final inspection to ensure the property is in agreed-upon condition. Your agent can assist in this process.

- Transfer keys to the buyer. Your lawyer can assist in this process.

- Cancel any existing utilities and notify relevant authorities.

Conclusion

Selling a landed property in Singapore requires careful planning, market awareness, and legal knowledge. By following this step-by-step guide, you can streamline the process while maximising your property’s value. However, navigating the complexities of property transactions can be time-consuming. Engaging an experienced property agent ensures a hassle-free experience, allowing you to focus on what truly matters. Our team of dedicated professionals is ready to provide tailored solutions to meet your needs. Contact us today and let us help you achieve a successful and seamless property sale.

Unsure about selling or renting out your landed property? Contact us for a friendly, no-pressure chat to discuss your needs.

Jae Tan, an award-winning ERA Realty Network agent and speaker at Real Estate Conversations, specialises in buying resale or new launch properties, selling, and renting homes. With multiple Top Achiever awards including The Myst (2025).

Known for sincerity and long-term client relationships, Jae delivers trusted results in Singapore real estate.

Connect with Jae today for your property needs!