Last Updated on January 29, 2026 by Editorial Team

Inheriting a home in Singapore often is a mixed bag of emotions. On one hand, it could be a meaningful gift from a dear loved one, but on another, now you’ve got to deal with the big responsibility of selling it.

From handling the paperwork to understanding the whole process, you might be a little overwhelmed, especially if you are still coping with the loss of a loved one.

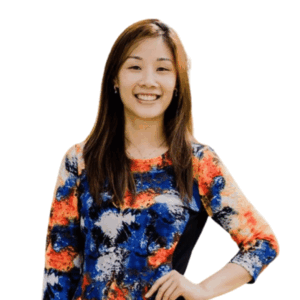

Legal Process for Inheritance

Inherited properties need legal authority before they are sold. If the deceased left a will naming beneficiaries, you’ll need to apply for a Grant of Probate in the Family Justice Courts, which typically takes one to three months and costs S$500 to $2000, including legal fees. If there isn’t a will, you’ll need to apply for a Grant for Letters of Administration, which takes two to six months, and costs about the same.

Then, submit the death certificate, NRIC copies, and property deeds. If the property has joint tenancy, it automatically transfers to the surviving owner(s), without probate. If the property has tenancy-in-common, a probate is required for the deceased’s share. You should get a good lawyer, and the total timeline is three to nine months. Once the probate is granted, then, you can transfer the title with the Singapore Land Authority (SLA) for private properties, or HDB for HDB flats. Fees for the title transfer are typically $100 to $500.

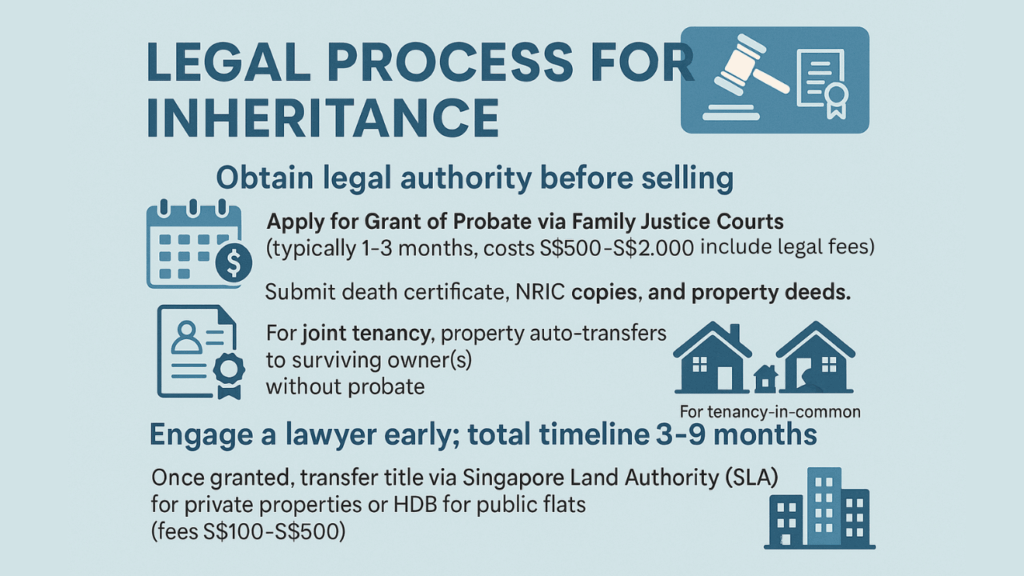

HDB-Specific Rules

Inheritance of an HDB flat comes with a few restrictions. Firstly, beneficiaries must be Singapore Citizens or PRs and meet the family nucleus requirement, like you cannot own private property if you are under 35. You also cannot own two HDBs, and you’ll need to sell one within six months of inheritance if you already have a flat after the Minimum Occupancy Period (MOP). If the inherited HDB is still within the MOP, which is five years from the key collection, you cannot sell the flat until the MOP has been met. However, it is possible to rent it out with HDB’s approval.

The Ethnic Integration Policy (EIP) and the Singapore Permanent Resident Quota (SPRQ) will apply to buyers. If there are multiple recipients of the inherited property, all must agree to sell, or that ones that don’t want to have to buy out the others using HDB’s resale process. The valuation must be done by an HDB-appointed valuer, and the fees are $200 to $500. A resale levy of up to $50,000 from the proceeds of the sale will apply if the deceased received subsidies.

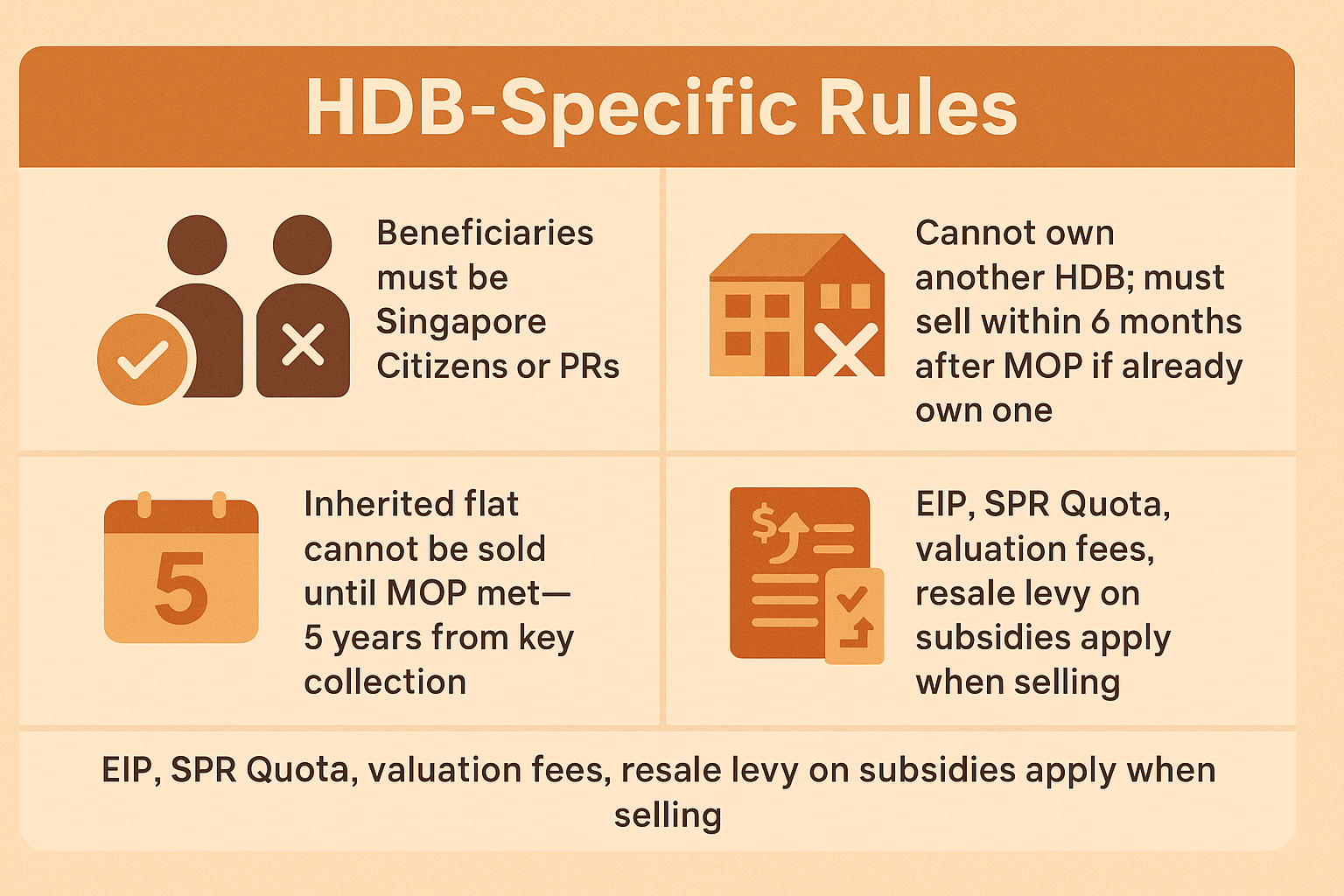

Condo-Specific Rules

Condominiums have fewer restrictions than HDB. You’ll need to transfer the property through probate or administration, then lodge the transfer with SLA, incurring $200 to $1,000 in fees. There is no MOP for condos, but check the en-bloc status or MCST rules. If there are multiple recipients of the property, partition with the court if there’s a disgreement, and this will cost a minimum of $5,000.

Foreign heirs might also face Additional Buyer Stamp Duty (ABSD) of up to 60% if retaining the property, but selling avoids this. Sellers Stamp Duty (SSD) applies if the property is sold within 4 years from the date of the deceased’s purchase. Rates are based on the holding period, and are currently at 16% year 1, 12% year 2, 8% year 3, and 4% year 4. The market segments (CCR/RCR/OCR) will also affect pricing, with CCR luxury units having more volatility than the more stable OCR mass market. `

Landed Property-Specific Rules

The sale of inherited landed property is similar to a condo, with a few key differences. Once you transfer the property with SLA, with fees $500 to $2,000, you’ll need to see whether the property is freehold or leasehold, as 99-year leases might deter certain buyers. Good Class Bungalows (GCBs) in prime locations like Districts 10 and 11 might fetch S$20 to $50 million but you’ll need foreign buyer approval under the Residential Property Act.

Subdivision is also possible for larger plots, but you’ll need URA approval, and this comes at a minimum $10k cost. SSD is the same as condos, which is four years from the purchase date. You might also want to conduct environmental checks, especially in flood-prone areas. If the property is heritage-listed, conservation rules apply, which will limit the modifications you can conduct.

Tax Implications

Inherited properties are not subject to stamp duty, as IRAS doesn’t consider it a purchase. Also, there is no capital gains tax in Singapore. However, you’ll need to continue paying property tax, which is assessed at 4 to 26% of the Annual Value, amounting to $2,000 to $10,000 for an average HDB or condo.

SSD is payable if the four-year minimum holding period isn’t met, which can be significant. For example, if a one-million-dollar property is sold within a year, you’ll pay 16% tax, which is $160,000. Since 2008, estate duty isn’t payable, but check if the will was made before 2008. You’ll also need to deduct legal and selling costs from the proceeds to save on taxes, and consult IRAS for the latest rulings and advice.

Step-by-Step Selling Process

Here’s a step-by-step guide on how to sell your inherited property in Singapore.

Valuation

Get an HDB-approved valuer to conduct the valuation, which will be valid for three months. You can also use a private valuer like SRX or 99.co tools, or an accredited valuer. This will cost $500 to $1,500.

Appoint Property Agent

Now you’ll need a reputable agent to help sell your property. Expect to pay a commission of 1 to 2% of the sale price, and try to get an exclusive agreement for more efficient marketing.

Prepare Documents

Your agent will better advise you, but you can prepare some documents first like the title deed, probate grant, NRIC copies, floor plans, and renovation records.

Marketing The Property

You or your agent should start listing your property on online portals like PropertyGuru or 99.co. Basic listings are free, but staged properties tend to sell 70% faster. They cost approximately $1,000 to $5,000.

Option to Purchase (OTP)

Once you’ve received an offer from a potential buyer, the buyer will have to pay a 1% option fee. After the option period of 14 to 21 days, the buyer will then exercise the Option to Purchase (OTP) with a further 5 to 9% deposit.

Completion

The completion of the purchase is typically 8 to 12 weeks after the OTP. Your lawyer will handle the conveyancing, which will typically cost $2,000 to $5,000. You’ll also have to pay off any loans or taxes from the proceeds of the sale.

Property Sale Timeline

The timeline for post-inheritance transfer is typically three to six months.

Common Challenges and Solutions

Not all things go smoothly, and here are some common challenges that you might face while trying to sell your inherited residential property in Singapore.

Multiple Heirs Disagreement – If there are multiple recipients of the property, you might have disagreements. If so, you’ll need to mediate with a lawyer or court, which will cost about $5,000 to $20,000, depending on the complexity. If you want to buy the other recipients out, the price will be the market value multiplied by the percentage of the property owned.

Outstanding Loans – If there is an existing mortgage, the sales proceeds will have to cover it. You can also use CPF for HDB flats.

Market Timing – Timing is everything when it comes to the sale of property. In 2025, GDP growth is projected to be low. Also, pay attention to the mortgage rates, and hold if the rates drop.

Foreign Heirs – If you aren’t a Singaporean citizen or PR, sell it through a proxy to get the ABSD rebate if buying a replacement.

Unsold Risk – Leaving the property unsold carries some risk, so consider selling about 5% below market value if you want to sell urgently. Vacancy rates of about 7.1% signal soft demand in the market.

Unsure about selling or renting your inherited property? Contact us for a friendly, no-pressure chat to discuss your needs.

Jae Tan, an award-winning ERA Realty Network agent and speaker at Real Estate Conversations, specialises in buying resale or new launch properties, selling, and renting homes. With multiple Top Achiever awards including The Myst (2025).

Known for sincerity and long-term client relationships, Jae delivers trusted results in Singapore real estate.

Connect with Jae today for your property needs!