Guide to Selling Commercial Property in Singapore

Last Updated on September 17, 2025 by Editorial Team

Discover how to sell commercial property in Singapore with our guide. Learn key steps, financial tips, and legal insights for a smooth, cost-effective sale process.

Selling a commercial property in Singapore’s thriving real estate market can be highly rewarding. If you’re looking to cash out on your investment, this guide will help you navigate the complexities of the sales process.

From pricing to legal requirements, here are the essential steps for a smooth and successful transaction.

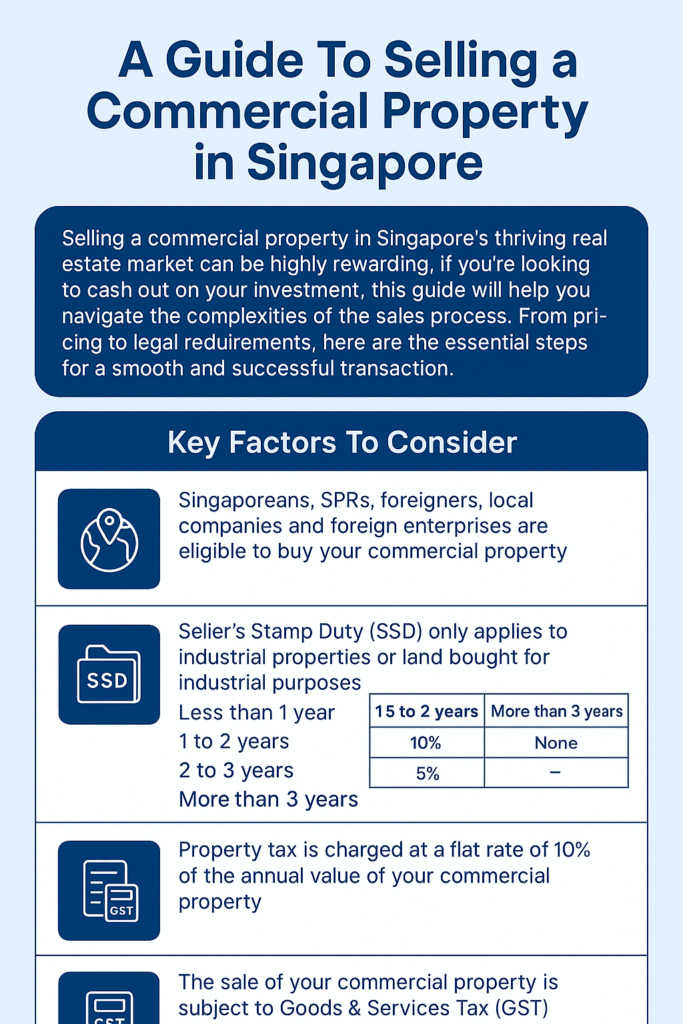

Key Factors To Consider

There are a few basic information about the commercial property market that you should know:

- Singaporeans, Singapore Permanent Residents (SPRs), foreigners, local companies and foreign enterprises are eligible to buy your commercial property in Singapore. However, if the property is zoned for mixed commercial and residential, foreign buyers must obtain government approval before purchasing it.

- Seller’s Stamp Duty (SSD) only applies to commercial properties like industrial properties or land bought for industrial purposes. If you are selling an office or retail space, you don’t need to pay SSD.

SSD for commercial properties is based on the sale price or market value, whichever is higher:

- Less than 1 year – 15%

- 1 to 2 years – 10%

- 2 to 3 years – 5%

- More than 3 years – None

- Property tax is charged at a flat rate of 10% of the annual value of your commercial property. If you have already paid the tax before selling your property and wish to be reimbursed by the buyer, it must be spelled out clearly in your Option to Purchase (OTP).

- The sale of your commercial properties in Singapore is subject to Goods & Services Tax (GST). Your buyer must pay the GST in cash only.

If you’re unsure about whether to start selling your Commercial Property or rent it out we are here to help. No pressure, no hard sell, but just a friendly chat for us to understand your needs and help you along.

Step-By-Step Guide To Selling Your Commercial Property

Typically, it takes several months to finalise the transfer of ownership to your buyer. Here are the basic steps to selling a commercial property in Singapore:

1. Understanding the Market Conditions

The first step is to assess the current market conditions. Economic performance, mortgage interest rates, government regulations, and overall demand for commercial spaces can easily impact your property values and saleability.

Efficient ways to research the market condition include:

- Research recent commercial property transactions – Check past sales of similar properties in your area to gauge pricing trends.

- Monitor demand and supply of properties similar to yours – A high supply of similar commercial properties might make selling more competitive.

- Review market reports – Research online portals of property-related organisations like SRX, the Urban Redevelopment Authority (URA), and Savills for up-to-date market insights and data.

With a clear understanding of market conditions, trends and demands, you will be more equipped to set a realistic selling price for your commercial property and plan a timeline to execute your marketing plan.

2. Engage a Property Agent

Engaging a professional property agent can help you streamline the selling process. An agent with a vast amount of knowledge and practice in the commercial property sector can offer tremendous market insights and pricing strategies you may not have considered.

These agents are often well-connected to a wide network of property buyers and could present opportunities you can’t access via mainstream marketing channels. Primarily, hiring a good agent ensures you get the best deal while handling complex procedures on your behalf.

3. Appoint a Conveyancing Lawyer

Singapore has strict regulations governing commercial property transactions. A conveyancing lawyer ensures that your sale adheres to local laws and that all the legal documents get up to speed with minimum input from you.

Additionally, your lawyer is tasked to manage financial arrangements for the transaction and handle due diligence such as running checks on the buyer’s financial status and ensuring the transaction is free from encumbrances or legal disputes. In the event of a dispute, the conveyancing lawyer can also provide legal advice and negotiate with the buyer’s lawyer on your behalf.

4. Get a Property Valuation

An accurate property valuation is vital to attract serious buyers and derive a realistic selling price that is based on professional valuation guidelines.

Some factors that professional valuers would consider includes:

- Location – Proximity to transport hubs, business districts, and amenities.

- Property type – Office spaces, retail shops, or industrial units have different valuation metrics.

- Condition of the property – Renovated and well-maintained properties typically fetch higher prices.

- Rental yield – If the property is tenanted, the rental income influences valuation.

You can get a professional property valuation for your commercial property in Singapore from firms like Savills Singapore, Knight Frank Singapore, and CBRE Singapore.

5. Market the Commercial Property

If you decide to engage professional agents to sell your property, do note that they will undertake the entire process from marketing and viewing to price negotiation.

One of the most common marketing strategies to attract potential buyers and maximise visibility for property listings is leveraging online property platforms. Advertising on real estate portals like PropertyGuru, 99.co, EdgeProp, and CommercialGuru (specific to commercial properties) is a popular tactic amongst agents and property sellers in Singapore.

Your property listing should include:

- High-quality images of your commercial property

- Clear pricing

- Compelling description of key selling points

- Specifications of the property

6. Accept an Offer, Issue OTP

When you receive an offer that you can’t resist, your next step is to issue an OTP to the buyer and collect an option fee, typically 1% of the property price. The OTP should include the selling price, option fee, downpayment, option date, completion date and any special conditions mutually agreed upon.

The buyer must exercise the option within 3 weeks (negotiable). If the buyer fails to meet the deadline, you can retain the option fee and consider new offers from other buyers.

7. Completing the Sales Process

The actual sales process is set in motion when the buyer exercises the option within the agreed period and makes payment for the remaining down payment in cash. From this point, your conveyancing lawyer will take over the transaction and initiate contact with your bank, the buyer and the buyer’s lawyer to finalise the transaction.

On your end, there are 2 financial obligations you need to fulfil in order to complete the sale:

- Pay SSD – If you are selling an industrial property or land bought for industrial purposes within three years of purchase, you will incur SSD which can be paid via the Inland Revenue Authority of Singapore’s (IRAS) e-Stamping Portal.

- Redeem your mortgage loan – If the property is under a mortgage, you must clear the outstanding loan before the sale completion.

8. Completing the Transaction

Your commercial property should be ready for occupation or restored to the condition mutually agreed upon before the completion day. The buyer will also conduct a final inspection before taking over the ownership of the premises.

Selling a commercial property in Singapore is a multifaceted process that requires in-depth market knowledge, effective marketing, and legal expertise. Whether you’re an investor, business owner, or a first-time commercial property seller, engaging an experienced property agent is your ticket to smoother transactions and more efficient processes.

Selling your commercial property? Let our team of trusted agents help you unlock your property’s full potential and achieve your real estate goals today! Contact us now!

If you’re unsure about whether to start selling your Commercial Property or rent it out we are here to help. No pressure, no hard sell, but just a friendly chat for us to understand your needs and help you along.

Jae Tan, an award-winning ERA Realty Network agent and speaker at Real Estate Conversations, specialises in buying resale or new launch properties, selling, and renting homes. With multiple Top Achiever awards including The Myst (2025).

Known for sincerity and long-term client relationships, Jae delivers trusted results in Singapore real estate.

Connect with Jae today for your property needs!